When GST was first introduced in 1994, it was 3%. It went up to 4% in 2003, then 5% in 2004, and finally to 7% in 2007.

It’s been 28 years since GST was first introduced in 1994 and in that 28 years, GST has gone up by 4%. 28 years is the equivalent of one generation. In one generation, GST has gone up by 4%. But how much as salary grown in one generation? Definitely much more than 4%.

Many are asking the Government to implement a wealth tax so that the top earners can contribute more to Government Revenue. GST is indeed a form of wealth tax because the more one spends, the more GST he pays.

Cars

Let’s take an example. A top-range Ferrari selling for $1.5 million. At 7% GST, the buyer pays $39,000 in GST. At 9% GST he will have to fork out $51,000. It’s an additional $12,000 in GST.

In 2019, 43 Ferraris, 61 Lamborghinis, 24 Rolls-Royces, 21 McLarens, and 21 Aston Martins, 7800 Mercedes, 5300 BMWs and 2100 Lexus were sold. Plus another 75000 Hondas, Nissans, Toyotas, Kia etc.

Can you imagine the increase in the amount collected in GST when it goes from 7% to 9%? You do the math. It’s not a small sum.

High living

Let’s take another example. 10,000 super rich people making merry and spending on exquisite wine and food at top restaurants and private clubs. If the spending per head is $1,000 (before GST), it is a whopping spending of $10,000,000 (before GST) in total. That’s $700,000 collected in GST at 7%, or $900,000 at 9%. This is just on fine-dining alone. We are not even talking about the super-rich splurging on Hermès, Patek Philippe and other big item purchases!

Casting the net wide

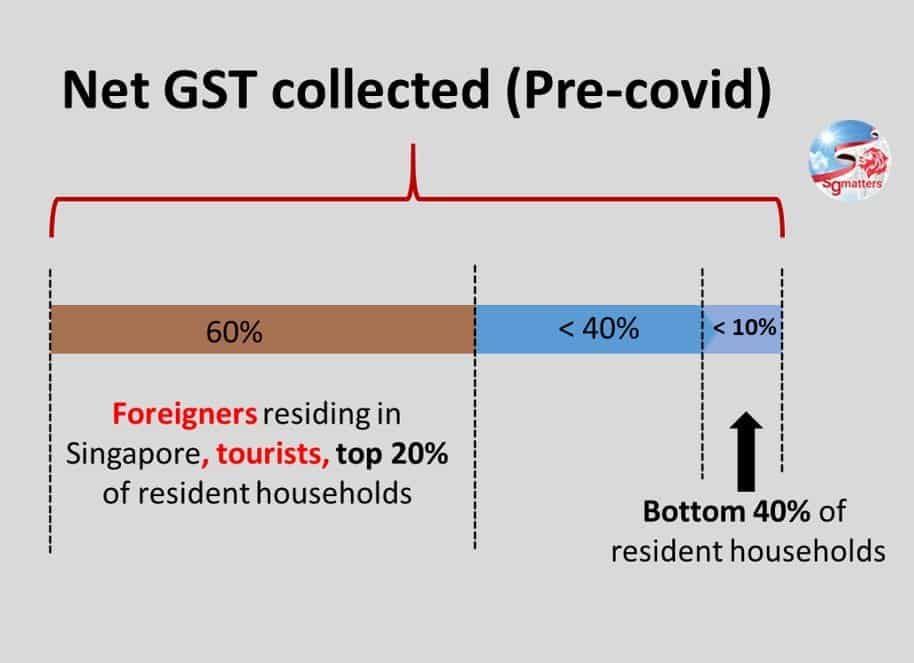

Do you realize that the GST allows the government to cast their net wide to tax a large group of consumers to raise revenue to spend on Singaporeans? What better way than the GST to tax spending by tourists here to raise revenue to spend on Singaporeans? Tourism may have taken a hit by the COVID-19 pandemic but in pre-covid time, tourists, together with foreign workers working here and the top 20% of resident households accounted for a whopping 60% of GST collected. This is after taking into account GST refunded under the Tourist Refund Scheme for goods bought here for consumption abroad.

Meanwhile, the bottom 40% of resident households (yes, 40%) accounted for less than 10% of net GST collected.

A regressive tax?

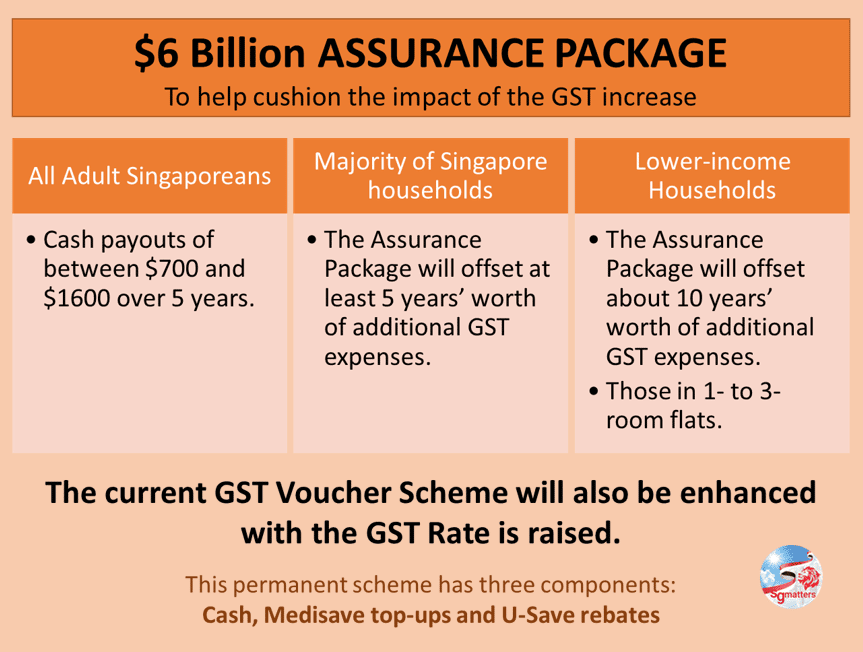

Some argue that GST is a regressive tax because for the same product, the rich and the poor are paying the same amount of tax. To solve this problem, the Government has put in place the GST Voucher Scheme. This is a permanent feature of the annual budget comprising cash support, utilities rebates and Medisave top-ups to help the lower income group offset part of the GST expenses.

Through this scheme, part of the GST revenue is flowed back to those who need it most, particularly the lower-income and retiree households. This scheme will be enhanced with the GST hike takes place.

Furthermore, the Government has also announced a $6 billion Assurance Package to cushion the increase for all Singaporeans. This provides a bigger and thicker cushion to the lower- and middle-income, including many seniors, and ensures that lower-income households will pay less than those who are well-off.

The package effectively delays the impact of the GST increase for the majority of Singaporean households for at least five years. For lower-income Singaporeans, the offset will be even higher – and hence, there is effectively no increase for them for 10 years.

Nobody likes taxes, not even finance ministers

"Nobody likes taxes, not even ministers for finance. As a government, our approach is to tax lightly, so that people can keep most of what they earn, and so that they can decide how best to spend it for themselves and for their families. But there are many critical, national needs that are better met by government provision, through taxes."

A shared responsibility for society's needs

Healthcare facilities and services benefit all Singaporeans. Good and affordable pre-school services and education to give all children, including our children with special needs, a good start in life and the best chance for success, regardless of background, and giving seniors a better quality of life are a shared responsibility of all. It is thus fair that we should all shoulder a small part of this responsibility