One thing is certain: supermarkets giving 1% discounts on essential items for a limited period of time is not equal to a policy to exempt ‘essential’ items from GST.

First, the discount is only for a limited period of time while an exemption policy is ‘forever’.

Secondly, a discount of 9% for all time – and not just 1% for a limited period of time – would be the preconditions to qualify being described as exemption from GST.

It’s no wonder that Senior Minister of State Chee Hong Tat expressed his puzzlement at WP Jamus Lim’s Facebook post on the 1% GST hike and retailers giving discounts.

The context to Jamus’ post is that big retailers like Giant, Sheng Siong and NTUC had decided to absorb the 1% GST hike for certain essential items for a period of time (3 months from January 2024 in the case of Sheng Siong, and 6 months from January in the case of Giant and NTUC).

Temporary discounts not equal to policy exemption

Incredibly, Jamus had likened the discounts given by supermarkets to his and Ms He Tingru’s suggestions that items deemed as essential be exempted from GST.

As SMS Chee rightly pointed out in a Facebook post, “This is factually inaccurate.”

“What he and Ms He had proposed was an exemption of GST by the government for what they deemed as “essential goods”, and not about retailers choosing to temporarily absorb the GST increase on their own accord,” said SMS Chee.

‘Essential’ goods

How do we define ‘essential’ goods? Is it to be limited to food? What about clothes? Even the mobile phone is an essential item today.

The line between essentials and non-essentials is often ambiguous and unclear, as SMS Chee explained. For example, rice may be considered as an essential staple but not when it is part of an expensive sushi dinner

SMS Chee pointed out that previously, DPM Lawrence Wong had explained why GST exemption by the government for “essential goods” is ineffective in practice.

“Other countries that have tried this have encountered numerous difficulties, as the line between essentials and non-essentials is often ambiguous and unclear,” Mr Chee elaborated in his post.

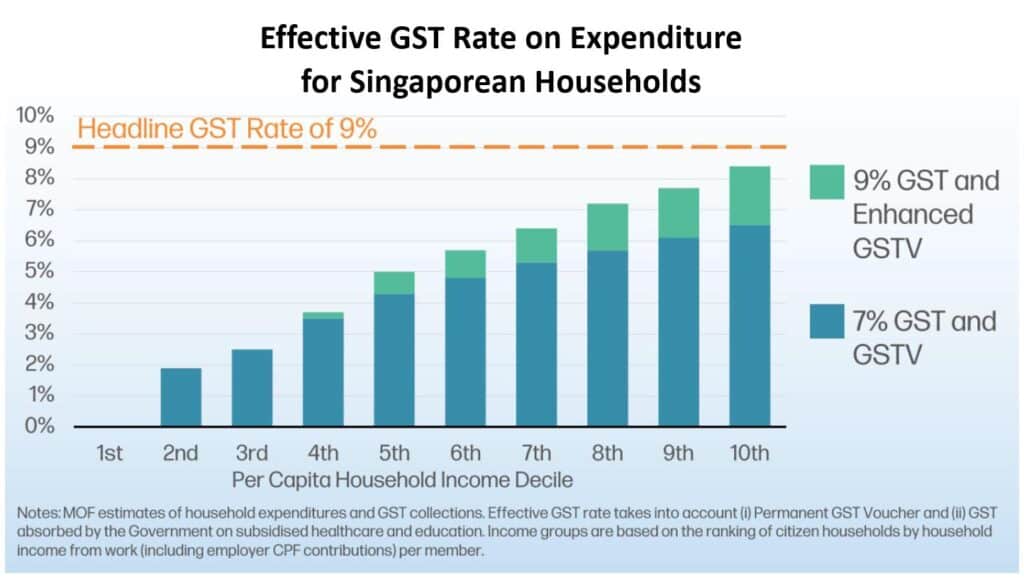

Any exemption from GST will benefit the well-to-do more because they spend more.

In this respect, it is important to note that it is the top 20% of citizen households that pay the greater share of the GST.

SMS Chee wrote that learning from the experiences of other countries, we have developed our own distinctive GST system in Singapore – one that is fairer and more effective.

MOS/Mayor Low Yen Ling and CAP

SMS Chee revealed that MOS/Mayor Low Yen Ling and her Committee Against Profiteering (CAP) members have been tirelessly engaging supermarket chains and merchants to offer discounts and other offers.

This behind-the-scenes work is what benefits our people, through concrete actions and outcomes, he said.