Since the GST was introduced on 1 April 1994, the WP had opposed it as a ‘regressive’ tax. At every stage also when the GST was hiked – 4% in 2003, 5% in 2004 and then 7% in 2007 – the WP had opposed it.

Had it not been for the recent exchange in Parliament between Health Minister Ong Ye Kung and WP Leon Perera, Singaporeans would not have known that the WP no longer oppose the GST but merely oppose the 2% hike.

The Workers’ Party has not been upfront about this change of position on the GST.

Why do I say this? Let me explain.

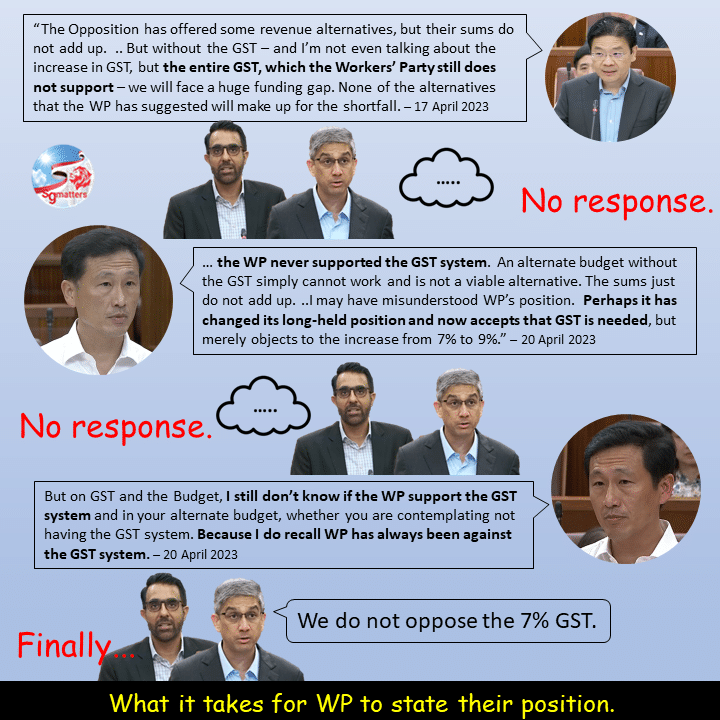

In his speech in Parliament (17 April) on the President’s Address, DPM Lawrence Wong said that while the Opposition has offered some revenue alternatives, their sums do not add up. This is because there would be a huge funding gap without the GST.

Here’s what DPM Lawrence Wong said:

“The Opposition has offered some revenue alternatives, but their sums do not add up. .. But without the GST – and I’m not even talking about the increase in GST, but the entire GST, which the Workers’ Party still does not support – we will face a huge funding gap. None of the alternatives that the WP has suggested will make up for the shortfall.

The WP did not respond...

Three days later, on 20 April, when Health Minister Ong Ye Kung spoke in Parliament, he reiterated the point that DPM Wong made, that without the GST, the sums do not add up.

Here’s what Mr Ong said:

“.. to do more, one has to spend more, and one has to say where the money is to come from. However, the WP never supported the GST system. An alternate budget without the GST simply cannot work and is not a viable alternative. The sums just do not add up. You cannot give up a major source of revenue and yet want to spend more in so many areas.

I may have misunderstood WP’s position. Perhaps it has changed its long-held position and now accepts that GST is needed, but merely objects to the increase from 7% to 9%.”

Again, the WP did not respond..

Minister Ong asked again..

This prompted Mr Ong to ask again whether the WP oppose the GST system, or whether they merely oppose the hike.

Here’s what Mr Ong said:

“But on GST and the Budget, I still don’t know if the WP support the GST system and in your alternate budget, whether you are contemplating not having the GST system. Because I do recall WP has always been against the GST system. And if that is the case, I would say it does not make sense. It’s not a viable alternative, nor a serious alternative because without the source of revenue, it’s not possible to do more.”

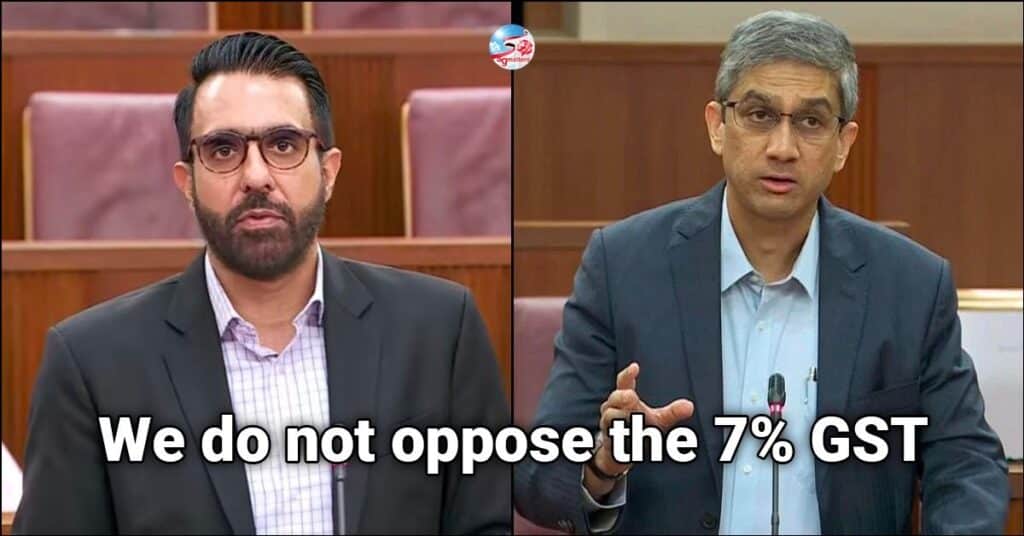

WP finally clarifies on their position..

It was only on being probed a second time on their position on the GST that Mr Perera finally said that the WP accepted the reality of the GST because the amount of revenue that is generated by the 7% GST is so substantial.

“.. the GST at 7% is something we do not oppose..,” he said. According to Leon Perera, that has been their position since 2018.

What WP supporters say

WP supporters told me that the WP accepts the reality of the GST because they did not have a choice. By this, they mean that there is nothing the WP can do to change a PAP policy. Now, we all know from Leon Perera’s response to the health minister that this is not so.

Leon Perera’s response was that the WP supports the GST because it provides a very substantial source of revenue for spending. Too much tradeoffs will be involved if the GST were to be abolished.

The WP have not been open about their changed stance from opposing to now supporting the GST because it is politically more expedient to let voters continue to think that they oppose the GST.

But deep down, the WP know and they know and they know that the GST is a sustainable way to raise revenue for much needed spending.

But they oppose the 2% hike because they also know that they also know that this is a sure vote-getter.

The arithmetic is simple

The arithmetic is simple. If you want to do more, you need to find the money to do more. You need more revenue. The budget has to be balanced.

If the WP accepts the reality of the GST because of the substantial amount of revenue it collects, then surely it is not unreasonable to assume that in time to come they will also accept GST at 9%.

Think about it.

At 7%, the net GST collected for 2021 is $12.6 billion, just $1.6 billion short of the $14.2 billion collected from individual income tax in the same year. After the 2% hike, revenue from GST will surely surpass revenue from individual income tax.

Turning the GST into a very progressive tax system

The GST, together with the Enhanced GST Voucher Scheme, Workfare and other transfers such as S&CC rebates, amounts to a very progressive tax system.

Our GST rate is still much lower than the VAT rates that are applied across the developed world. Why?

It’s because we have kept it simple – flat, across the board – and collect as much as possible from the upper-income group through the GST and use that revenue to subsidise and help uplift the lower-income group.

Let’s not pursue a path of easy giveaways without the means to finance it because it is not fiscally possible or sustainable.