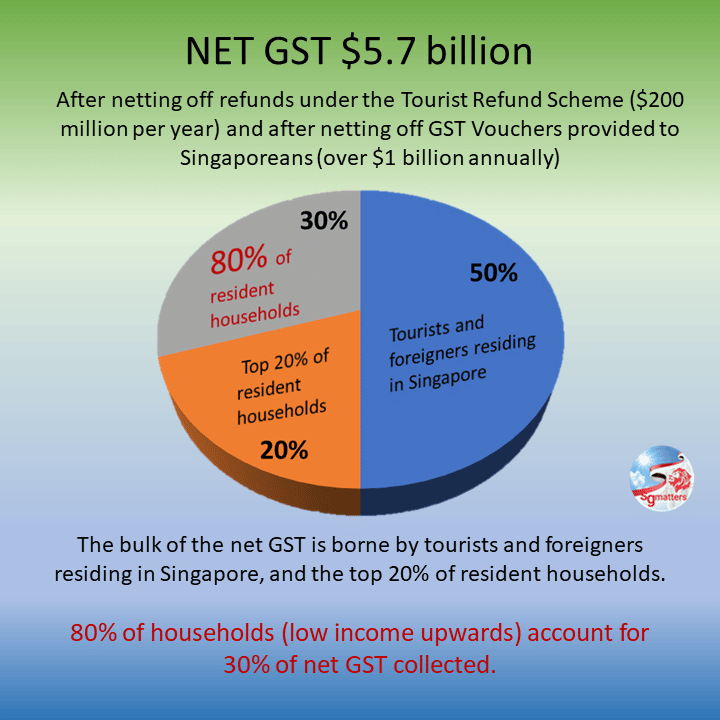

The bulk of the GST burden is borne by tourists and foreigners living in Singapore, as well as the top 20% of resident households, Senior Minister of State for Finance, Mr Chee Hong Tat said in Parliament.

Around $5.7 billion were collected in NET GST annually in 2018 and 2019.

This is after netting off refunds under the Tourist Refund Scheme ($200 million a year) and after netting off GST Vouchers of over $1 billion provided annually to Singaporean households.

This means 30% of the net GST collected is spread over 80% of resident households.

GST increase

Delay GST hike? Your wish is granted!

The $6 billion Assurance Package is now $8 billion, taking into account the elevated inflation situation.

For those who ask the Government to delay the GST rate increase, the Assurance Package in effect does precisely that, for the majority of households.

GST is permanent. The GST Voucher Scheme is also permanent.

Multi-tiered GST System

It is one that is tiered by income levels, with lower-income households paying a much lower effective GST rate than higher-income households.

The full impact of the GST will be borne largely by higher-income households, as well as tourists, and foreigners who are based here – and this is also the group that contributes the biggest share to net GST revenues from households and individuals.