The FTX Exchange (“FTX”) was a centralized cryptocurrency exchange with derivatives and leveraged products.

FTX was founded in 2018 by Sam Bankman-Fried, an MIT graduate and former Jane Street Capital international exchange-traded funds trader.

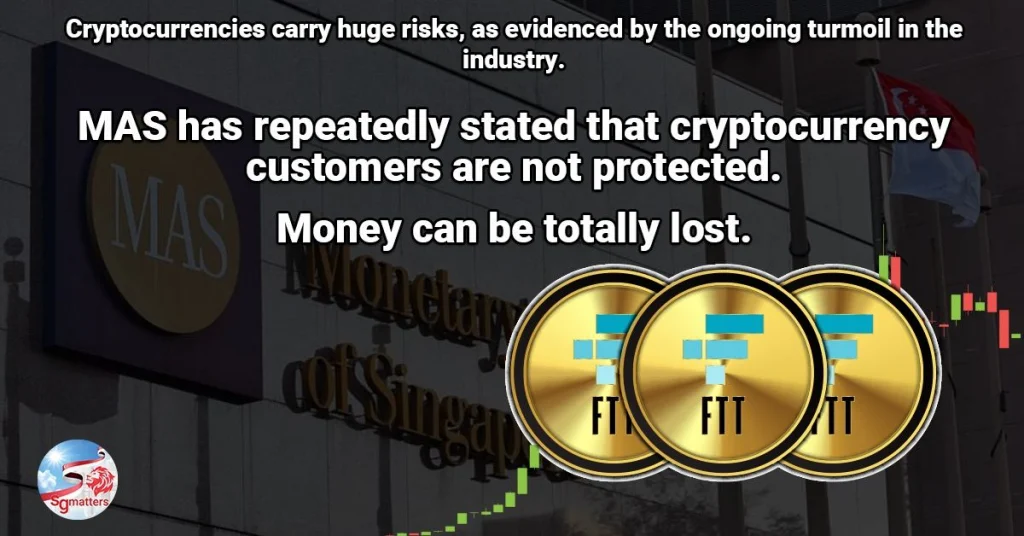

Due to its collapse, many misconceptions have arisen, so the Monetary Authority of Singapore (“MAS”) released a statement on November 21 addressing some of these misconceptions.

Misconception #1

"MAS does not allow Singapore users to use Binance, most of them moved to FTX. All of them will have lost everything now"

The truth is that as both Binance.com (“Binance”) and FTX are not licensed here, there is a clear difference between the two: Binance actively solicited Singaporean users while FTX did not.

Misconception #2

Why MAS treated Binance differently from FTX, specifically why it was placed on the Investor Alert List while FTX was not?

Between January and August 2021, MAS received several complaints about Binance. In the same period, Binance was also found to be soliciting customers in multiple jurisdictions without a license.

This is why Binance was specifically added to the Investor Alert List (“IAL”), while FTX was not.

Binance was ordered to stop soliciting Singapore users by MAS. Binance took various measures to assure MAS that it was no longer doing so, including geo-blocking Singapore IP addresses and removing its mobile application from Singapore app stores. As a result, Binance demonstrated beyond doubt that it was no longer soliciting and providing services to Singaporeans. In the event that Binance decides to remove some of these restrictions now, it must continue to comply with the prohibition against soliciting Singapore users without a license.

MAS has consistently warned about the dangers of dealing with unregulated entities.

Because FTX is unlicensed and operates offshore, MAS cannot protect Singaporeans who deal with it.

Misconception #3

There are hundreds of these exchanges and thousands of offshore entities accepting non-crypto investments. It is impossible to list them all, and no regulatory body has done so.

In addition to the IAL, MAS maintains a Financial Institutions Directory on its website that lists all MAS-regulated entities.

A key lesson from FTX is that cryptocurrency trading is hazardous on any platform.

Crypto exchanges are not immune to failure. In Singapore, even if a crypto exchange were licensed, it would only be regulated to reduce money-laundering risks, not to protect investors. It is similar to the approach currently taken by most jurisdictions. Recently, MAS published a consultation paper proposing basic investor protection measures for crypto players licensed to operate in Singapore.

Moreover, even if a crypto exchange is well-managed, cryptocurrencies themselves are highly volatile, and many have lost all value.