In Parliament, WP Jamus Lim suggests that scams victim should not have to bear more than S$100 to S$500 in losses, with banks and telcos bearing the rest of the costs instead.

Jamus Lim describes the Monetary Authority of Singapore’s (MAS) loss-sharing framework for phishing scams as “fundamentally unfair”.

Under this framework, financial institutions and telcos that were negligent will have to bear the responsibility of phishing scam losses ahead of victims.

The framework requires all parties – including consumers – to to be vigilant and to take precautions against scams.

Financial institutions will have the responsibility to protect their customers through robust controls to safeguard customer accounts, and effective measures to detect and respond to suspicious transactions.

On their part, customers have the responsibility to act with precaution such as by never giving away personal or banking credentials to anyone, never clicking on links in SMSes or emails which are claimed to be sent by a bank.

Jamus: too much responsibility placed on consumers

Jamus Lim says the framework is unfair because it places too much responsibility on the consumers who is often the ‘weaker link’ in a fraud.

Now, if consumers are the weaker link, shouldn’t this weak link be strengthened through education and awareness rather shielded from responsibility?

In summary, Jamus’ argument is simply that banks are rich, they have a lot of money and they can bear the losses, so they should just bear the losses and save the depositors from the ruinous impact of a scam.

Free people from responsibility?

Now, we know that scams are not a new thing. Scams have been around since time memorial. They have just evolved to keep up with the times.

It isn’t that people are not aware of scams. They read about it all the time. Deals too good to be true. Still, people fall for it.

It is foolhardy to think that a $100 or $500 ‘co-payment’ would result in consumers practising good cyber hygiene. On the contrary, it will encourage reckless behaviour and letting down of the guard. After all, what is the worse case scenario but a loss of $500?

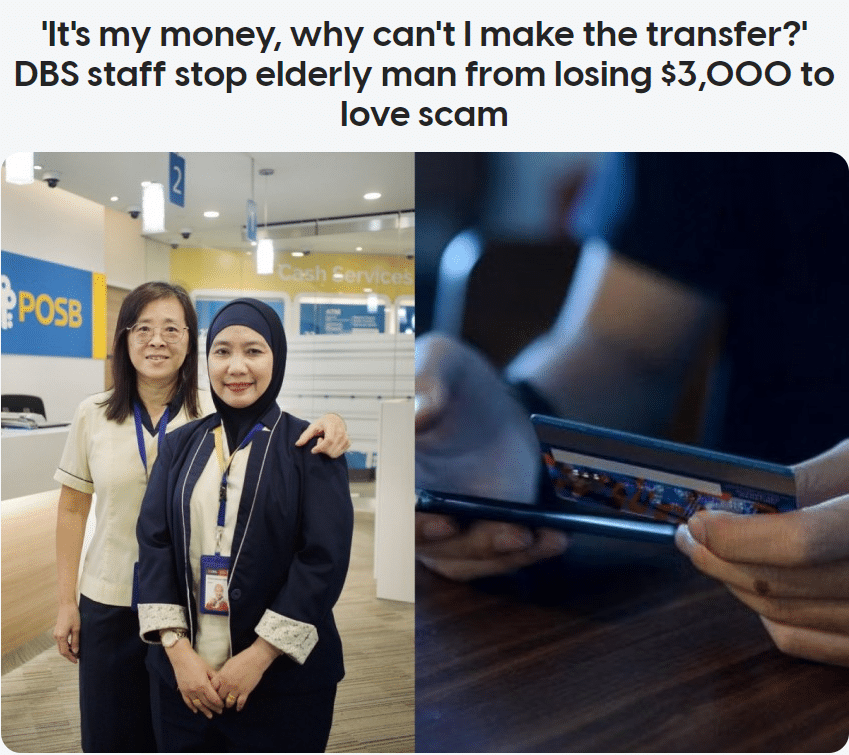

We have read of many stories of victims of love scams who even abused bank staffs who tried to dissuade them from transferring large sums of money to scammers.

Encouraging scams

Not only will Jamus’ suggestion that banks bear the losses regardless of the circumstances of the scam not help reduce scams, it will encourage and entrench scams in Singapore.

Do you know that globally, US$1.02 trillion were lost to scammers with Singapore being the country that lost the most, an average of US$4031 per scam victim? How can it be when we have a population that is highly educated?

The way to deal with scams is not to free people from their responsibility to protect their own finances, but to keep educating them to be alert to scams, and to impress on them to do their utmost diligence and responsibility.

Working to combat scams

The Singapore Police, together with various banks in Singapore. have been working hard to combat scams.

A recent ST report in January 2024 tells of the police’s Anti-Scam Centre, which together with DBS, UOB, OCBC and Standard Chartered Bank, employed robotic process automation (RPA) technology to identify job, investment and other scam victims. RPA uses bots or artificial intelligence to learn and then replicate repetitive tasks.

More than 48,000 SMSes were issued to the victims by banks and the police, interrupting over 5300 scams in progress, and saving thousands from being scammed.

Whose money?

In just the first half of 2023, Singaporeans lost $330 millions to scams. Should banks be made to bear these losses?

A bank’s money is not its own. The money belongs to its hundreds of thousands of creditors who deposit their money with the bank in return for interest earned. Is it fair to depositors that their money is used by banks to ‘pay’ scammers.

A framework is being put in place to hold all parties to a responsible standard. Consumers must not shy away from this standard. They too must learn to do their due diligence.

Shielding people from the impact of a scam is not the way to scam-proof people.