70,000 CPF members will receive about $40 million in matching grants from the Government in January 2022 for the cash top-ups made to their Retirement Account (RA) between 1 January and 30 June this year, the CPF Board said in a press release on 18 August.

Singaporeans can use the Matched Retirement Savings Scheme to top up their retirement funds. These top-ups and matching grants will increase their monthly retirement payouts.

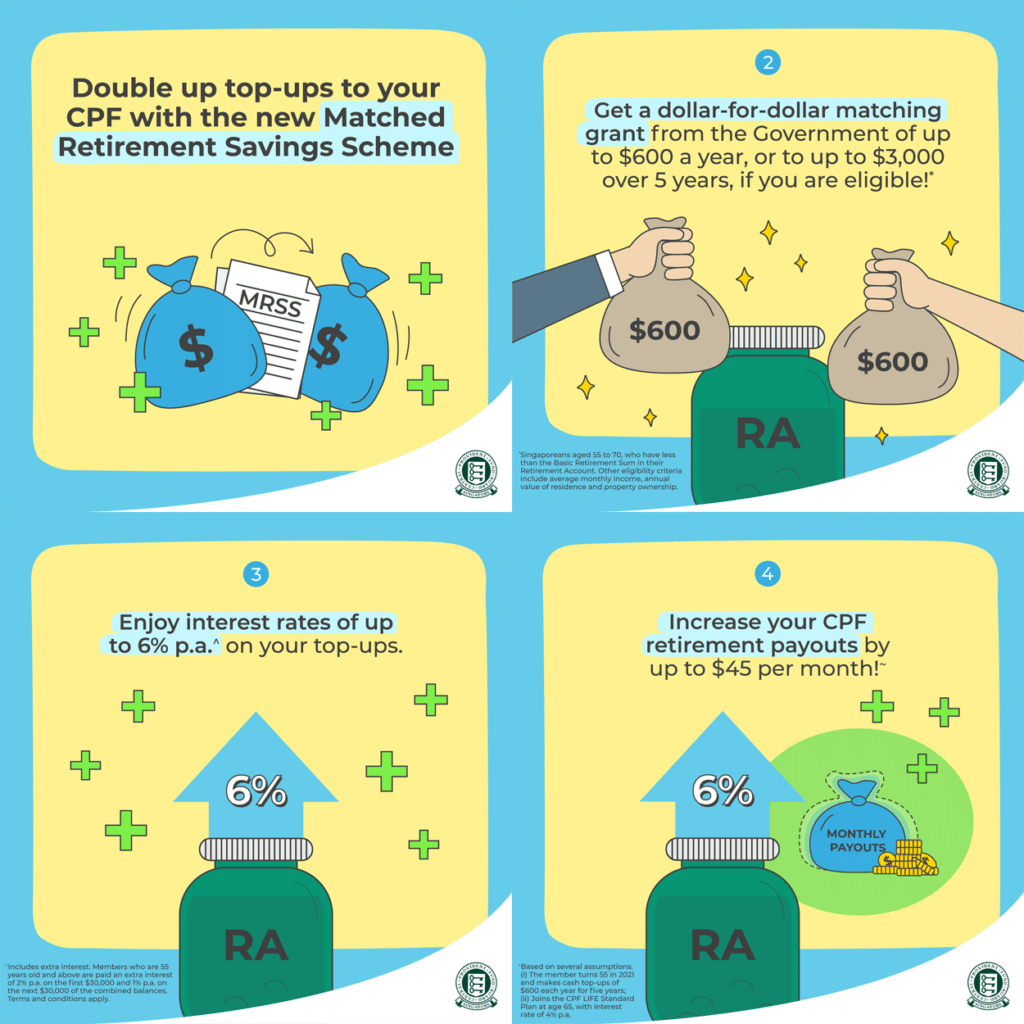

The Matched Retirement Savings Scheme (MRSS) was launched earlier this year to help seniors who have yet to meet the prevailing Basic Retirement Sum (BRS) save more for their retirement.

Start the scheme will run for five years. Under this scheme, every dollar of cash top-ups that are made to eligible members’ retirement accounts will be matched by the Government. This is subject to an annual cap of $600 and works out to $3,000 over five years. With dollar-for-dollar matching, that $3000 is doubled to $6,000. And this is before factoring in the attractive CPF interest rates of up to 6% per annum.

There are many more seniors out there who qualify for the scheme. Many may not be aware of the system or how to go about doing it. Or they may not even have the funds to do the top-ups.

The good news is that anyone can do the top-ups other than the members themselves. Their loved ones or employers can do the top-up for them. You don’t need to be a family member to top-up an eligible member’s RA (Retirement Account). Any member of the community can do so!

Indeed, 40% of the 70,000 had received top-ups from their loved ones, with the majority coming from their children.

Mr Jeffrey Lee, a CPF member in his 20s, is one such child. He has been topping up $50 monthly for his parents since the start of the year.

He said, “My parents have little CPF savings in their RA, and the MRSS would help them build up their retirement nest egg as the Government matches top-ups. I urge my peers to top up for their parents, as every dollar counts regarding retirement planning. This is especially so for parents who have started saving later.”

Notably, of the 70,000 members, 8 in 10 had received top-ups for the first time. And 9 in 10 had received top-ups of $600 or more.

Director from the Retirement Savings Department, Ms Ong Woei Jiin, said, “It is encouraging to see more seniors topping up their CPF accounts for the first time to benefit from the matching grant and attractive CPF interest rates. I am particularly heartened to see the children of eligible members stepping up to help boost the retirement savings of their parents. For other eligible members who have yet to make top-ups, we strongly encourage them and their loved ones to do so as soon as possible, as these top-ups and matching grants will allow members to enjoy higher monthly payouts in retirement.”

Don’t miss the opportunity! To receive the matching grant of up to $600 for 2021, cash top-ups to the RA of MRSS-eligible members must be made before the end of this year. So hurry up, folks.

The matching grants from the Government will be credited in January 2022.

Members can top up electronically via the CPF website or my CPU mobile app for greater convenience. Visit cpf.gov.sg/mrss to find out more about the Matched Retirement Savings Scheme.