Taxation is an intrinsic part of nationhood. It is unpleasant for the government. It is also unpleasant for the ones being taxed. But, it is an inevitable necessity.

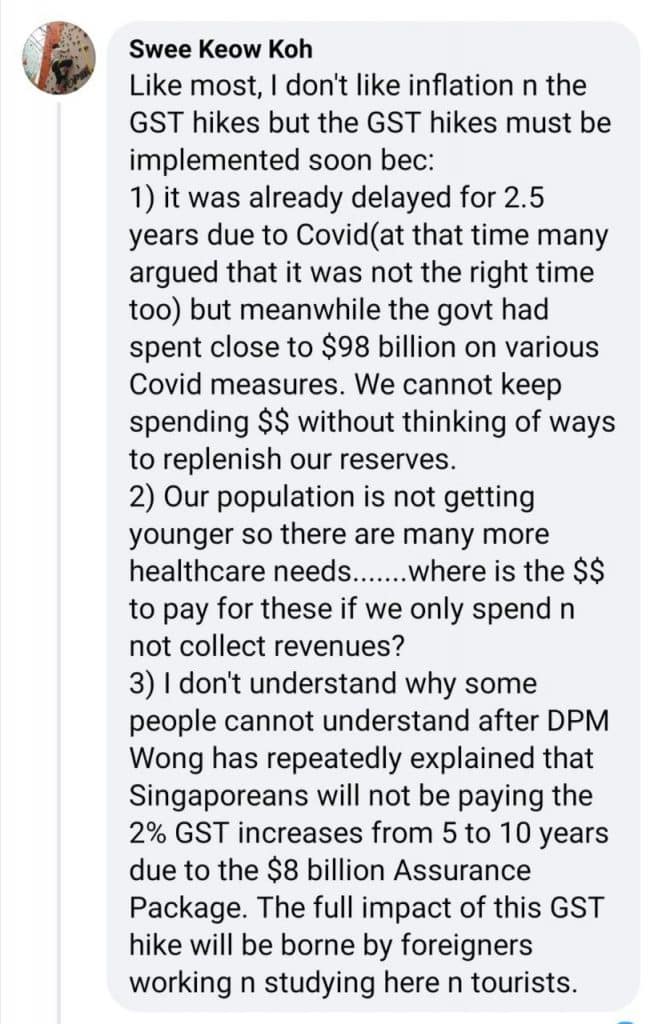

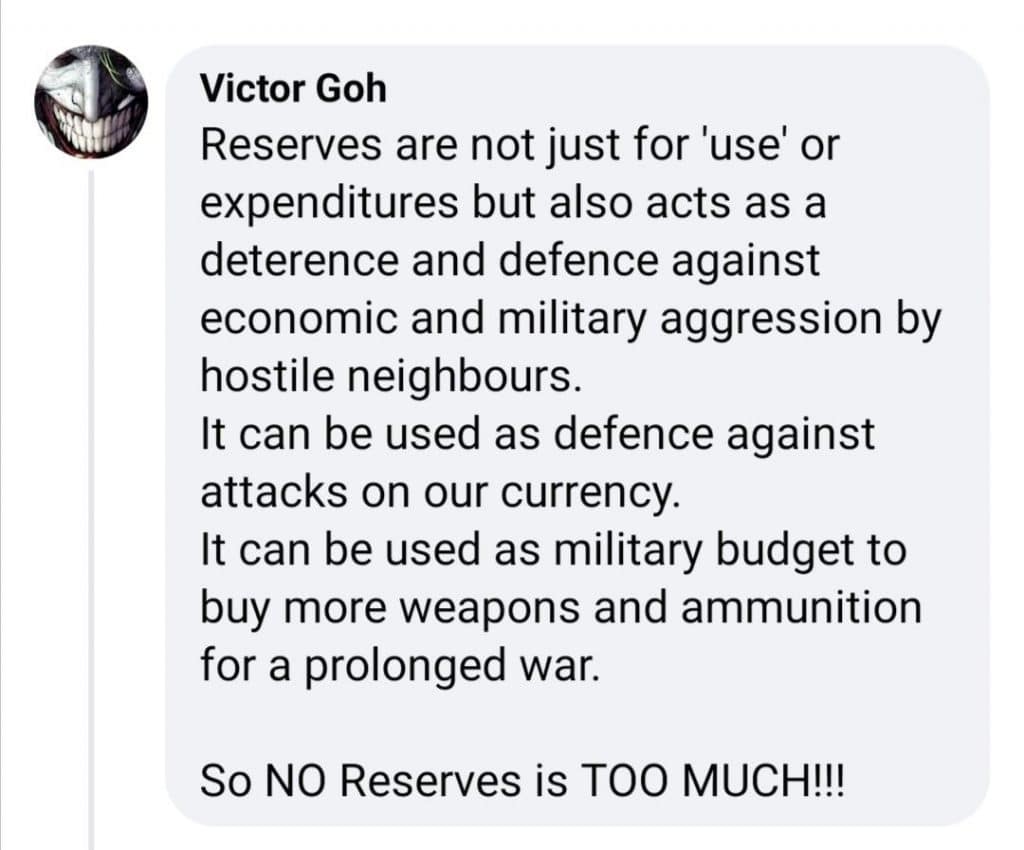

What are some of the responses of Singaporeans to WP’s proposal?

We need to be able to defend the Singapore dollar from a speculative attack. Just to give you an idea of the firepower that will be needed to defend the Sing dollar, in normal times, on average, the Sing dollar is traded with a daily turnover estimated at US$37 billion globally (or an annual turnover of US$9.5 trillion.)

With global warming, more diseases and pandemics are assured.

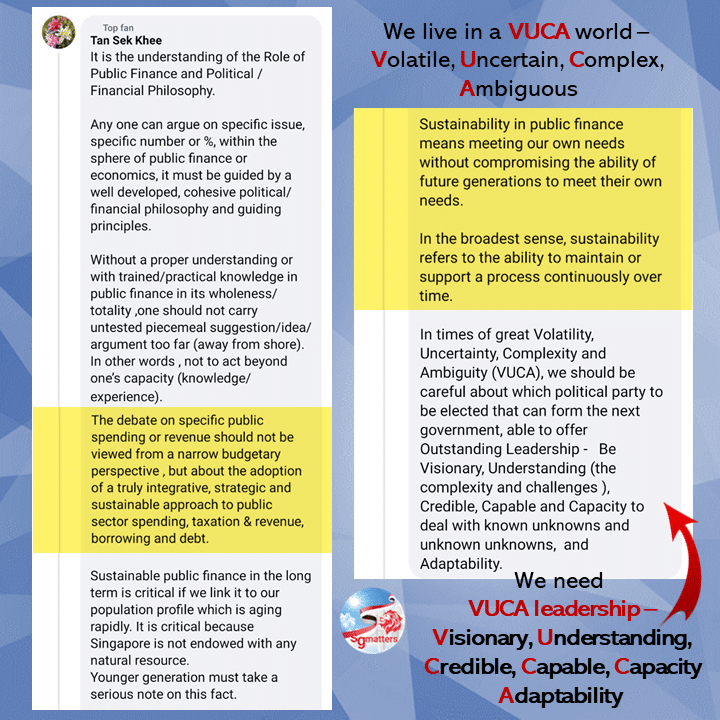

Mr Tan Sek Khee said that the debate on specific public spending or revenue should not be viewed from a ‘narrow budgetary perspective’. In the long run, Mr Tan said sustainable public finance is critical because our population is aging rapidly. This is a fact the younger generation must take a serious note, he said.

Which party is able to ‘offer Outstanding Leadership – Be Visionary, Understanding (the complexity and challenges), Credible, Capable and Capacity to deal with known unknowns and unknown unknowns, and Adaptability.

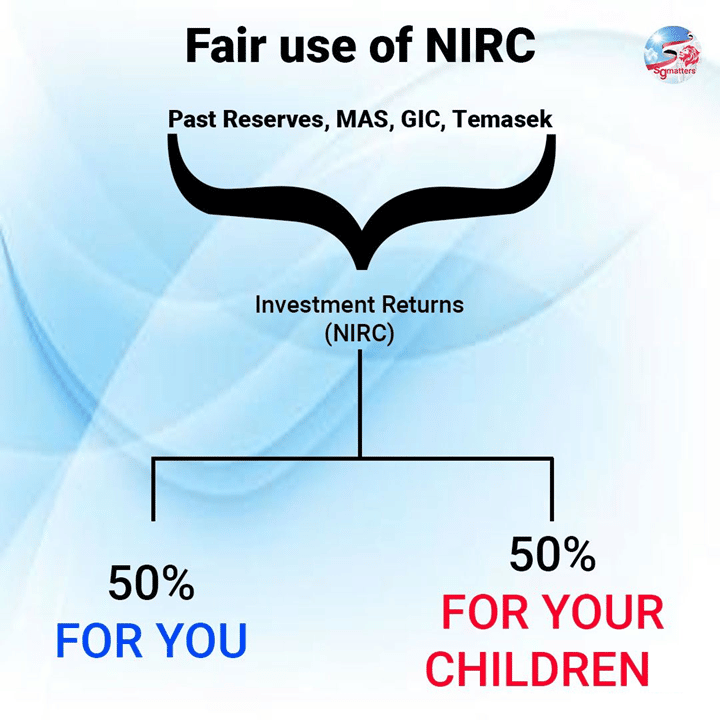

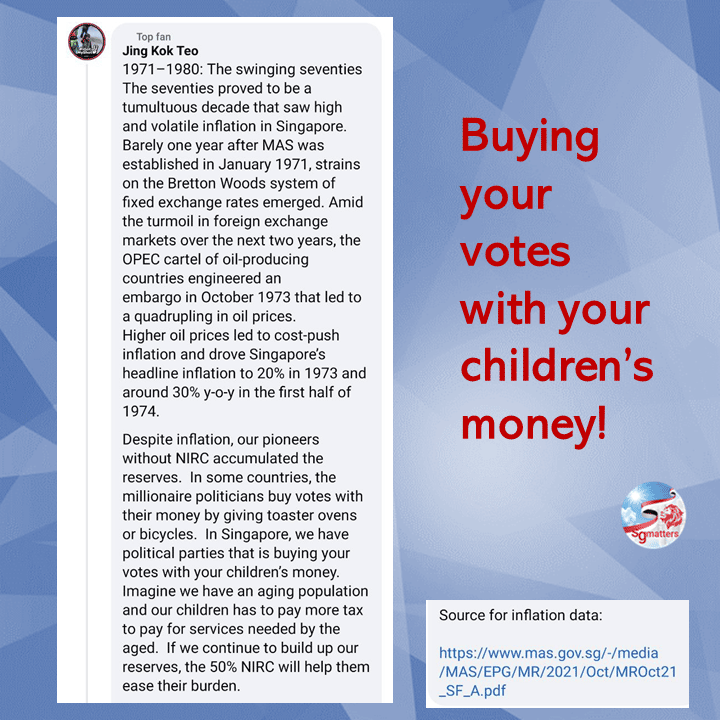

Under the NIRC Framework, the government uses 50% of the NIRC for today and leaves 50% to be reinvested for the future. This is a fair and equal use of NIRC for all generations of Singaporeans.

To ask for more for today and less for the future is to take from future Singaporeans.

The seventies proved to be a tumultuous decade that saw high and volatile inflation in Singapore. Barely one year after MAS was established in January 1971, strains on the Bretton Woods system of fixed exchange rates emerged. Amid the turmoil in foreign exchange markets over the next two years, the OPEC cartel of oil-producing countries engineered an embargo in October 1973 that led to a quadrupling in oil prices.