Since the end of the Circuit Breaker, demand for housing has pushed resale flats prices to a new high, with HDB resale prices rising for the 26th straight month in August 2022.

The sale of million-dollar HDB did not slow down. In September 2022 alone, HDB recorded another 45 million-dollar HDB flats transaction, more than the 33 million-dollar flats transacted in August 2022.

Rising HDB prices, and rising interest rates over the last year for home loans, are a cause of concern as people may have difficulties servicing their home loans or even default on mortgage payments.

Property Cooling Measures

Committed to keeping public housing affordable to help Singaporeans own their home, Minister for National Development, Mr Desmond Lee, on 29 September 2022, announced a slate of property cooling measures by the Government.

Different Housing to Cater Different Budgets and Needs

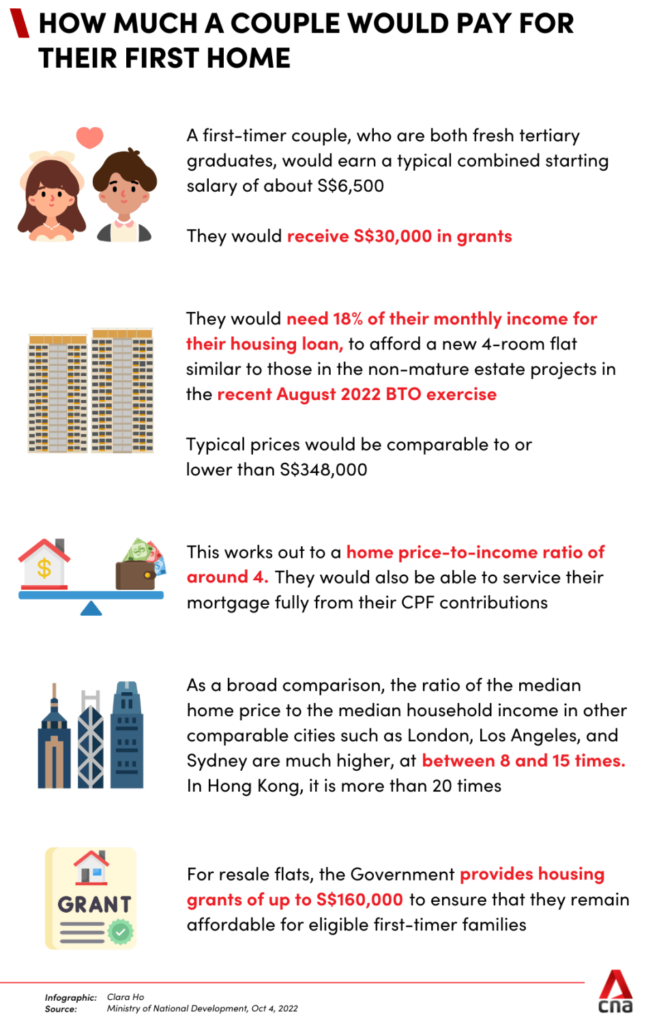

On top of the above measures, first-time buyers, whether purchasing a Built-to-Order (BTO) or a resale, receive significant subsidies and grants to their HDB flats so that buying their first home remains affordable.

When purchasing a BTO, first-time buyers enjoy brand new HDB flats at subsidized rates and Enhanced Housing Grants of up to $80,000, with more help for lower-income buyers.

As for flat resale buyers, the Government provides housing grants of up to $160,000, which price these flats below market value to ensure they remain affordable for those buying their first home. In 2021, about 7,000 families received grants for their resale flat purchase.

With the increase in subsidized housing, prices for HDB flats remained relatively stable, with the average cost of a 4-room apartment in a non-mature estate seeing a marginal increase from $341,000 in 2019 to $348,000 in the first three quarters of 2022.

Additionally, the new Prime Location Public Housing (PLH) model introduced in October last year provides additional subsidies on top of the substantial donations already offered for the BTO flats. This model extends the affordability of prime, central locations flats to a broader range of Singaporeans.

A Global Comparison

Buying a BTO is often the first and most popular start for Singaporeans to acquire their first home – if they are not in a hurry. The wide range of BTO flats in Singapore caters to the different housing needs and budgets of individuals and families.

Financing an HDB flat in Singapore is made affordable for first-timers, with the house price-to-income ratio and mortgage servicing ratio remaining relatively low compared to other countries.

Generally, Singapore’s home price to annual combined income ratio is at about 1:4 or 1:5, which is significantly lower compared to countries like Hong Kong, where it can go up to 1:20.

As for the mortgage servicing ratio, first-timers serving their apartment with an HDB loan generally fork out less than 25% of their monthly household income when servicing their housing loans. This means that when using CPF to finance their home loans, Singaporeans fork out little to no cash at all. Singapore’s mortgage servicing ratio is below the international benchmark of 30-35%.

Here is an illustration by a CNA that shows how a couple with a combined starting salary of $6,500 would pay for their first home:

Raising Supply of BTOs

Demand for public housing in Singapore has not cooled.

Considering this, HDB is prepared and on track to launch 23,000 flats per year in 2022 and 2023 to meet the strong demand for Public Housing. This is a 35% increase from the 17,000 flats launched last year. HDB is also prepared to launch up to 100,000 apartments from 2021 to 2025. This supply will be calibrated based on prevailing demand.

With many raising their concerns about long waiting times for BTOs, Minister Desmond Lee said that HDB will endeavour to launch more projects with a shorter waiting time of fewer than three years, where possible. The first batch of about 1,000 BTO flats with shorter waiting times was launched in the 2nd half of 2018 in Sembawang, Sengkang, and Yishun.

Public Housing Remains Affordable for Singaporeans

Senior Minister of State for Finance Chee Hong Tat said in a parliamentary sitting that the end mind is to encourage home ownership and to enable as many families as possible to own their homes. While we see many reports of million-dollar HDB flats, know that these transactions are not the norm and make up less than 1.5% of overall HDB flat transactions. Public housing generally remains affordable for Singaporeans, as PM Lee Hsien Loong reaffirmed in the National Day Rally 2022.