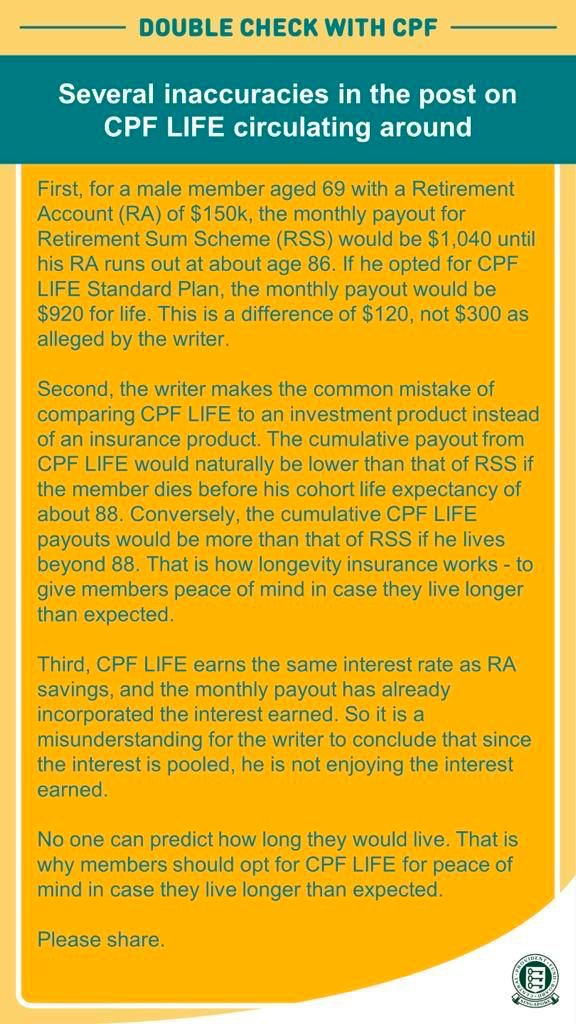

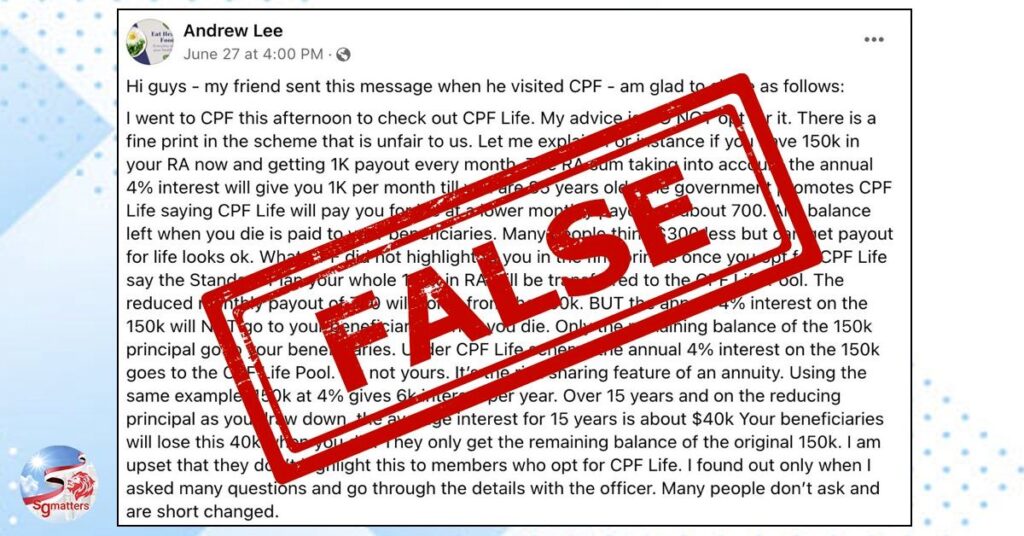

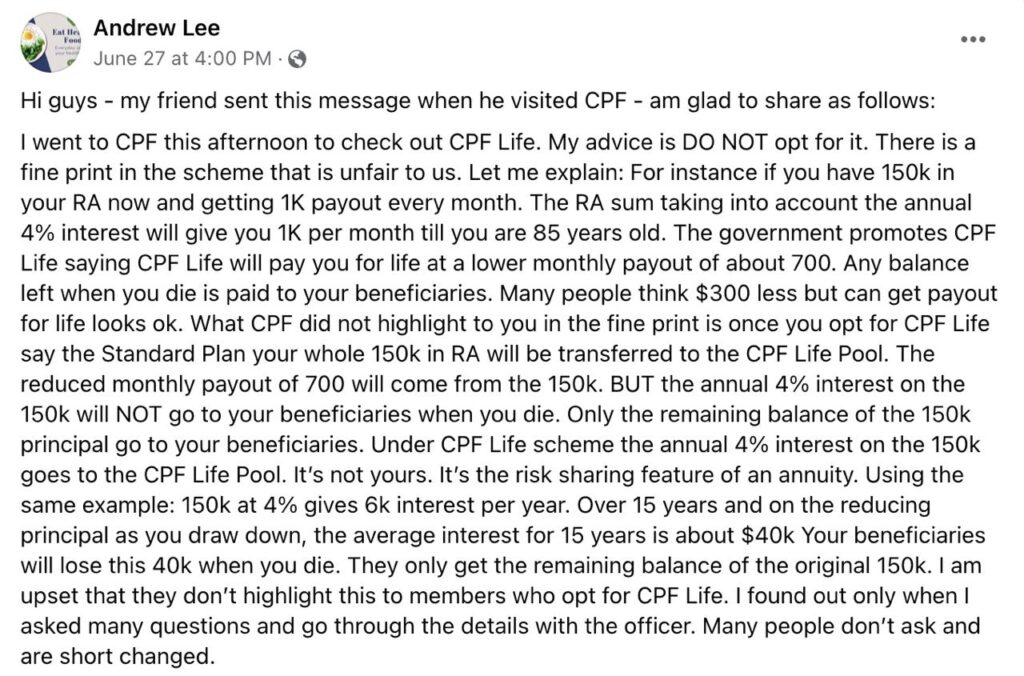

There are several inaccuracies in the post by Andrew Lee. The CPF Board has since responded to these inaccuracies.

First, for a male member aged 69 with a Retirement Account (RA) of $150,000, the monthly payout for Retirement Sum Scheme (RSS) would be $1,040 until his RA runs out at about age 86.

If he opted for CPF LIFE Standard Plan, the monthly payout would be $920 for life. This is a difference of $120, not $300 as alleged by the writer, CPF Board said in its response.

Second, the writer is wrong to compare CPF LIFE to an investment product instead of an insurance product.

The cumulative payout from CPF LIFE would naturally be lower than that of RSS (Retirement Sum Scheme) if the member dies before his cohort life expectancy of about 88.

Conversely, the cumulative CPF LIFE payouts would be more than that of RSS if he lives beyond 88. That is how longevity insurance works – to give members peace of mind in case they live longer than expected.