Recently, it emerged that WP MP Louis Chua’s professional position on public housing differs from his party position.

The WP MP has consistently maintained his party’s position that public housing is unaffordable. Yet, in his capacity as a research analyst, he wrote that housing affordability remained healthy.

In an exchange in Parliament on Wednesday (Apr 19), PAP MP Saktiandi Supaat said it was “odd” that Louis Chua appeared to take two different positions on whether housing in Singapore continues to be affordable.

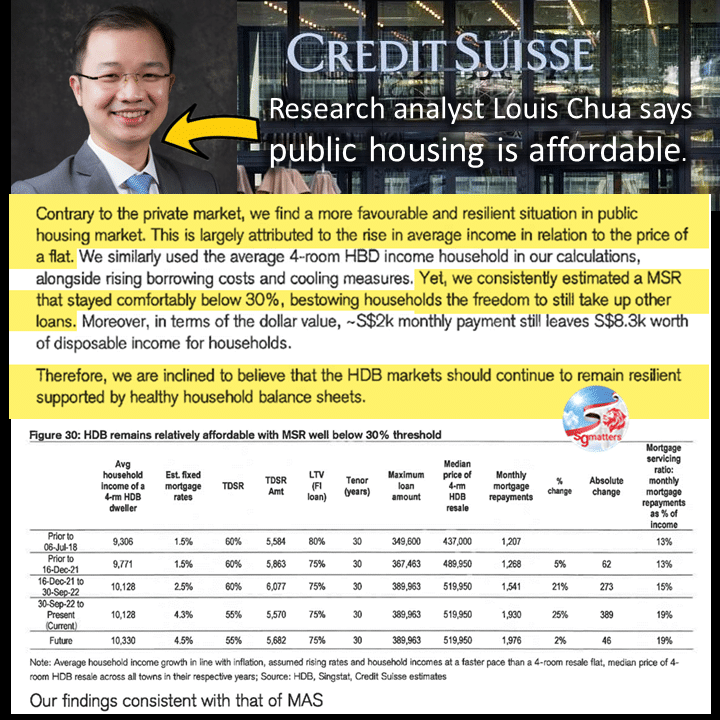

Saktiandi referenced a January 2023 report that Chua had co-authored in his professional capacity as a Credit Suisse research analyst.

In that 58-page report, titled Singapore Property Sector 2023 Outlook: A beacon of light comes into view, Chua made the point that affordability continues to be healthy for the average household, given wage growth momentum amid a tight labour market.

Income has risen, contrary to what the Opposition often asserted. In fact, based on the Credit Suisse report, income has risen faster than the price of public housing.

Louis Chua co-wrote that the public housing market is favourable and resilient. MSR remains comfortably below 30% ‘bestowing households the freedom to still take up other loans’.

Which Louis Chua is speaking the truth?

Clearly, Louis Chua the Member of Parliament and Louis Chua the research analyst have taken opposing positions on housing affordability.

Which Louis Chua do you believe? The Louis Chua who speaks in Parliament to voters to win their votes, or the Louis Chua who writes as an analyst for investors?

The answer is obvious.

Conclusion

Public housing remains affordable.