Taming inflation

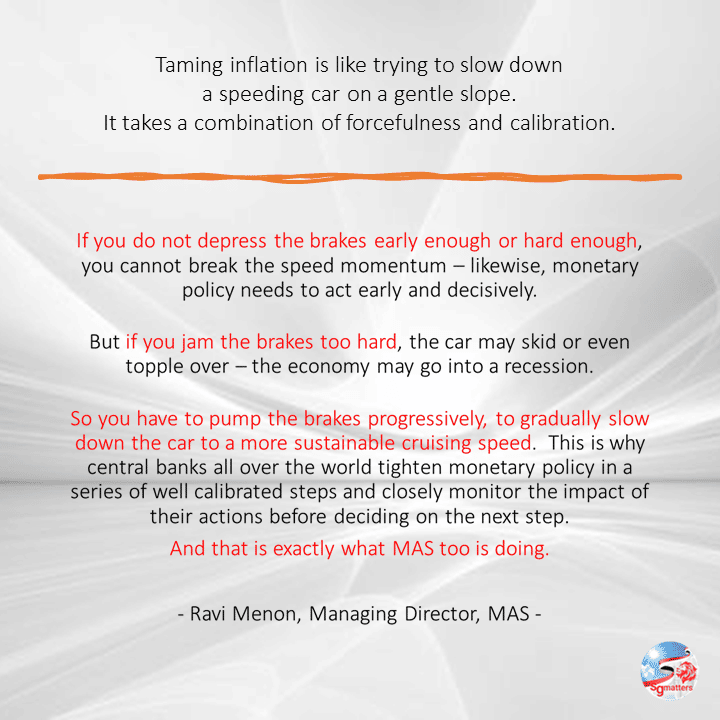

Monetary policy dampens inflation by reducing aggregate demand to bring it in line with aggregate supply.

In most countries, this is achieved through higher interest rates that dampen consumption and investment demand. Singapore’s monetary policy is centred on managing the exchange rate of the Singapore Dollar.

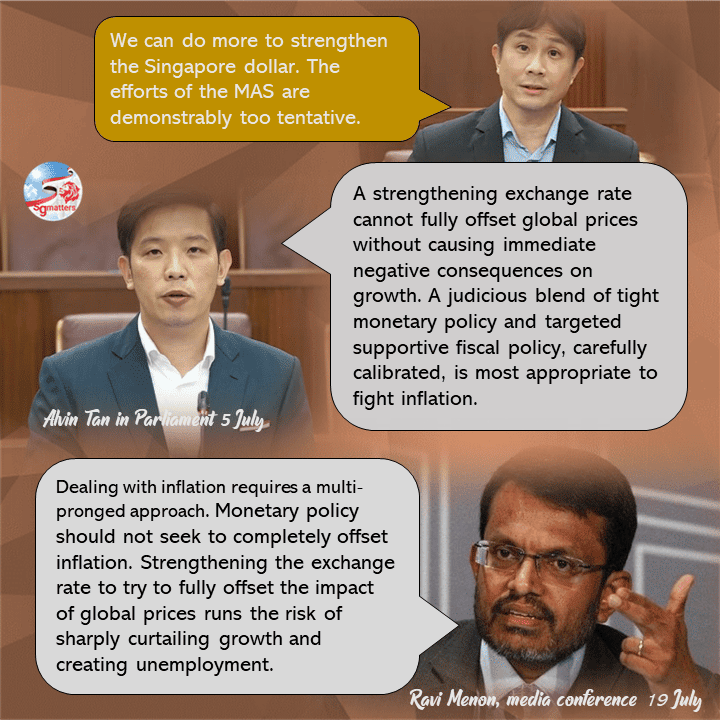

As MOS Alvin said in Parliament, strengthening the Singapore dollar will have immediate negative consequences on growth. Why? This is because a stronger exchange rate not only help to directly reduce imported inflation, it will also restrain export demand, though this will provide relief to labour market pressures.

Understanding the nature of the global rise in prices

It is important to understand the global nature of the price pressures we are facing. The magnitude of the rise in prices of energy and food that we see is such that it is not possible to completely insulate the domestic economy from these increases.

Targeted help without exacerbating inflationary pressures

As the Managing Director of MAS Ravi Menon said, the government has stepped in forcefully to support vulnerable groups who are less able to bear the sharp price increases.

The government has been careful that fiscal support does not add stimulus to the economy that could exacerbate inflationary pressures, he added.

Fiscal support has been targeted at the more vulnerable groups and designed to avoid stoking inflation or distorting price signals.

In Parliament, WP Jamus Lim had lamented how ‘more of us have to think twice before turning the air conditioner on’ because the price of electricity has gone up. Imagine if the government gives everyone money or absorbs all increase in tariffs so that everyone can happily turn on that aircon without thinking twice, then they will be adding to the demand-side pressure on inflation instead of dampening inflation.

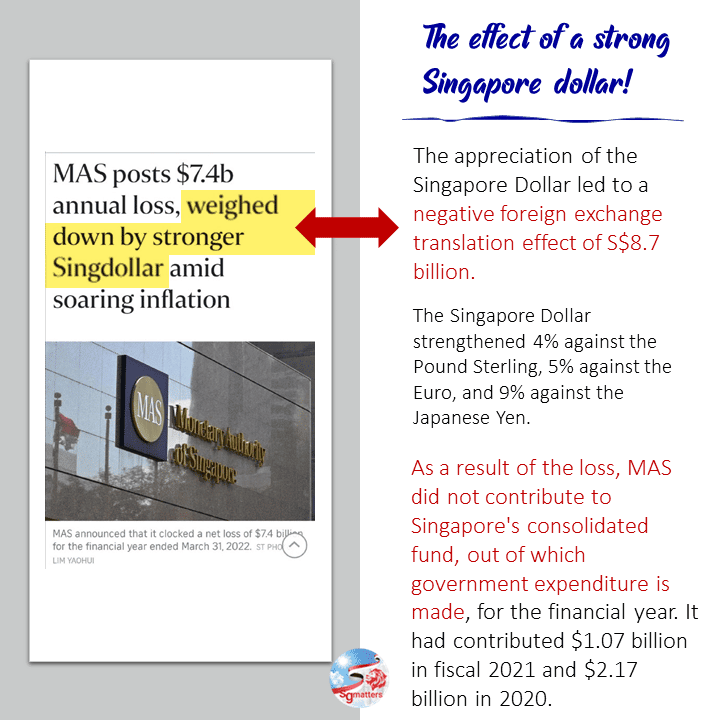

A strong Sing dollar and foreign exchange

The Singapore Dollar strengthened 4% against the Pound Sterling, 5% against the Euro, and 9% against the Japanese Yen.

Overall, MAS records a loss of $7.4 billion for FY2021/2022.

As a result of the loss, MAS did not contribute to Singapore’s consolidated fund, out of which government expenditure is made for the financial year. This means there is no Net Investment Returns Contribution from MAS for FY2021/2022.

[irp posts="14358"]