'Give me all my CPF at 55,' cry some.

WITHDRAWAL IN FULL AT 55

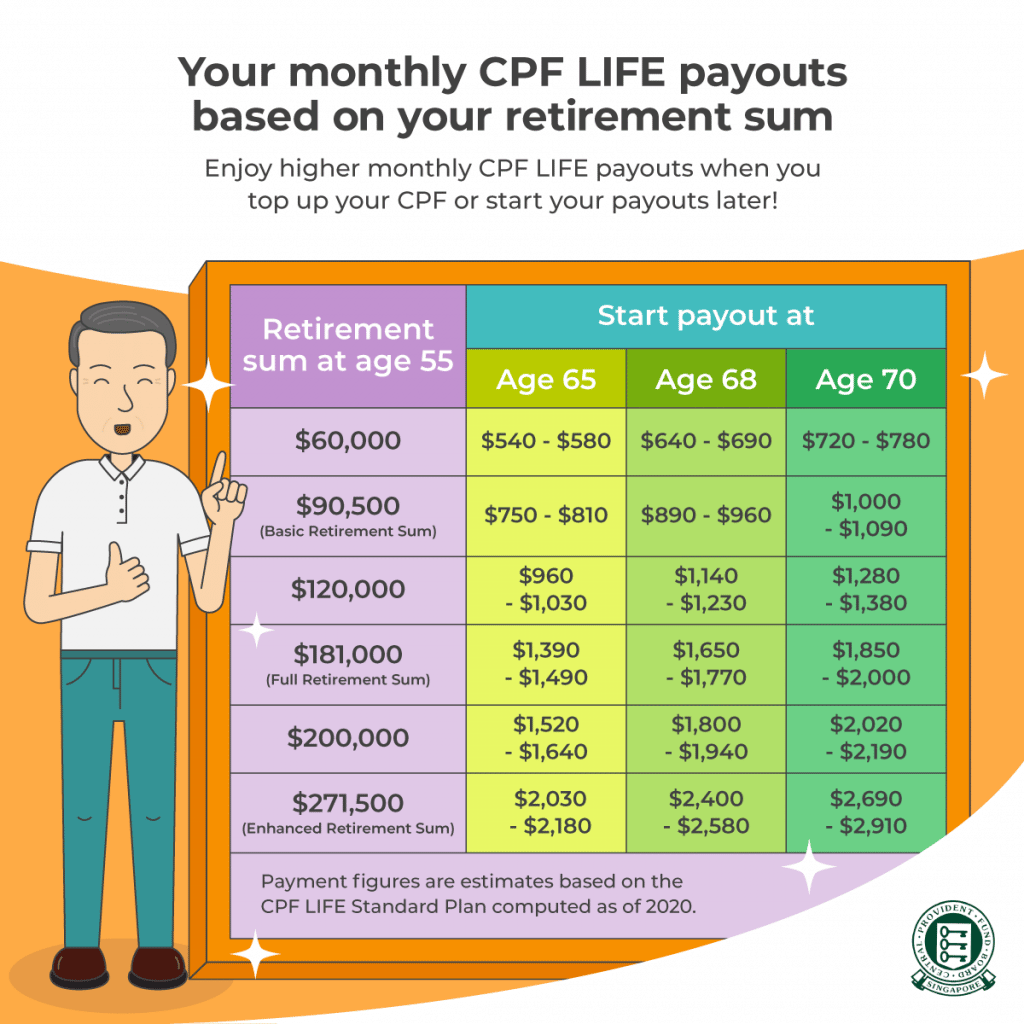

For example, if you plan on spending $500 a month until you are 85 and want a full withdrawal at 55, you’ll need $180,000.

You will need $360,000 in your CPF at 55 to last you until you are 85 if you double that expenditure to $1000 a month.

At 55, how many people are able to accomplish this?

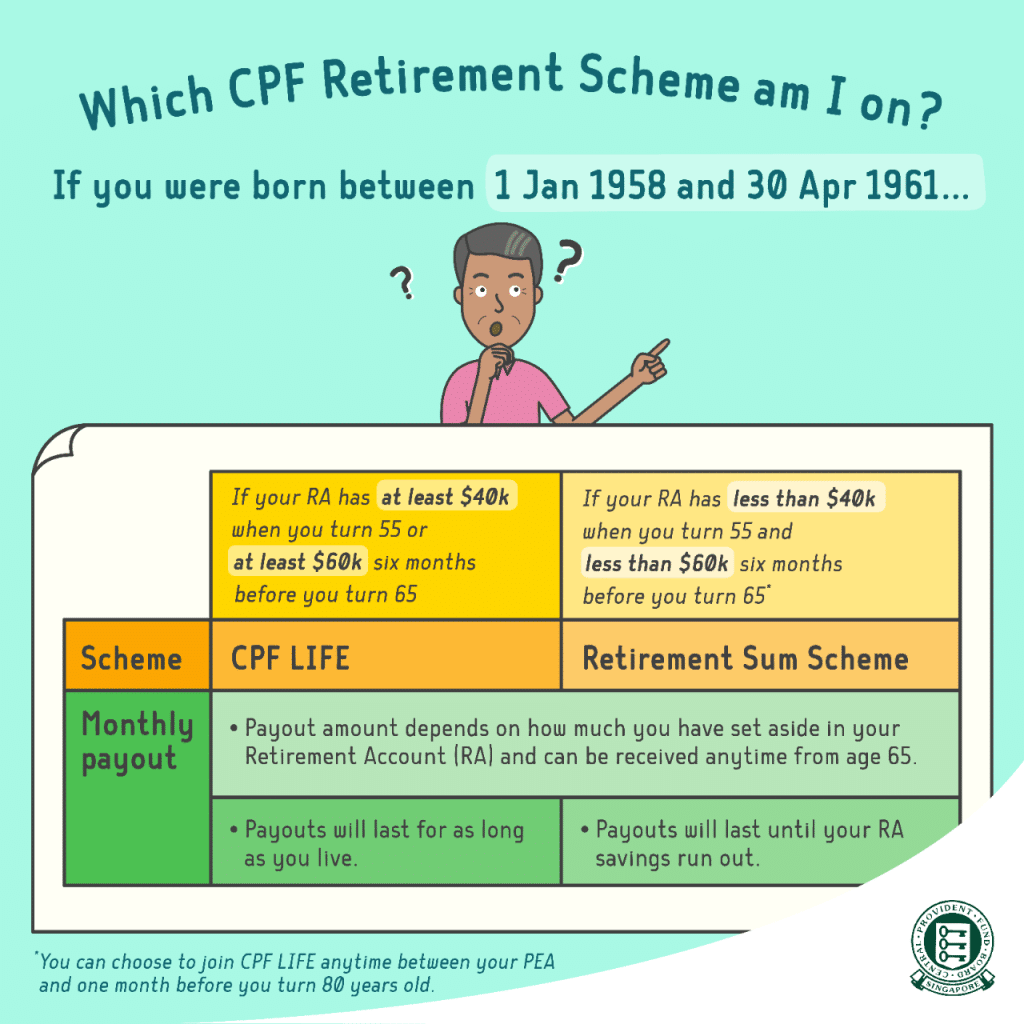

LET IT GROW AND DRAWDOWN AT 65

When you reach 55, you will only need $60,000 in your retirement account to receive a monthly payout of $500 from CPF LIFE.

Some people love it so much that they top up their retirement accounts to an enhanced retirement amount. This will enable them to enjoy a substantial and comfortable monthly payout for life.

Tan Ooi Boon, Straits Times’ Invest Editor, gave two reasons:

- As a result of listening to people with similar ignorance, the scheme is poorly understood. They don’t bother to check themselves. Following the wrong herd, they believe that withdrawal at 55 is prudent.

According to CPF Board statistics, half of the people who withdrew from their CPF at 55 deposited money in banks at lower interest rates than CPF.

There is a logical fear that if they leave any money in the CPF, they will not see it as the government will allegedly find more reasons to take it away from them.

Saving enough for retirement isn’t a luxury, it’s a necessity

In a society with a rapidly aging population and a smaller working population to sustain a growing pool of seniors, having sufficient retirement funds is vital.

The government has put a lot of effort into creating the retirement schemes of today.