What is a wealth tax?

What can be taxed?

Everything.

Your cash, your pension funds, your bank deposits, your shares, your jewelry, your cars, your house, your collectibles including your art pieces, and antiques, your inheritance, fixed assets, your luxury handbags and watches, any asset that could be appraised a monetary value.

The experiment in Europe

The experiment with the wealth tax in Europe was a failure. It started in 1990 with 12 countries. Today, there are only three: Norway, Spain, and Switzerland.

France’s wealth tax was killed by French president Emmanuel Macron in 2017. The tax contributed to the exodus of an estimated 42,000 millionaires between 2000 and 2012, among other problems.

Éric Pichet, author of a French tax guide, estimates the wealth tax ‘earns the government about $2.6 billion a year but has cost the country more than $125 billion in capital flight since 1998’

It was reported by the Telegraph that actor Gérard Depardieu moved to the Belgian town of Nechin straddling the French border in 2012 to avoid France’s wealth tax. Over time, the tiny, tranquil village of just over 2,000 people evolved into a magnet for scores of wealthy French citizens seeking to dodge Paris’s high-tax regime.

Why did it fail?

The hefty cost of enforcement played a big part in Austria killing their wealth tax back in 1993.

Finland, Sweden, and the Netherlands eliminated theirs in subsequent years for similar reasons. A constitutional court in Germany struck down the tax for its unequal treatment of different assets.

It turns out that taxing the rich is like playing a game of whac-a-mole. If you tax them in one jurisdiction, they pop up in another. If you tax only certain classes of assets, they buy up more of other classes.

The net wealth tax seeks to overcome this by taxing everything. But here’s the problem. It costs a lot to track and value rich people’s stuff every year. It’s not so simple to determine the value of each person’s assets. It takes an administrative army to hunt down and valuate everything, everywhere. Keep in mind that the very wealthy – unlike the middle class – has access to wealth planning services and the means to shield themselves from the taxman.

It didn’t raise much revenue.

According to reports by the OECD and others, there were some clear themes with the policy:

It was expensive to administer, it was hard on people with lots of assets but little cash, it distorted saving and investment decisions, it pushed the rich and their money out of the taxing countries—and, perhaps worst of all, it didn’t raise much revenue.

Spain now taxes household fortunes starting at 0.2% when they surpass €700,000 (S$1 million). The net worth thresholds are also much lower in Norway and Switzerland compared to the ones set by Madrid.

Switzerland is cited by WP Jamus Lim as the model example of a wealth tax that works. In Switzerland, the tax-free threshold for a married couple without children is between 50,000 Swiss francs ($50,370) to 250,000 Swiss francs ($251,856). The wealth tax thus affects much of the middle class in addition to the wealthiest families, as one study on the Swiss wealth tax found. If we use the same threshold for Singapore, like Switzerland, many middle-class Singaporeans will be affected.

Singapore Government open to wealth tax

Singapore has some forms of a wealth tax. The Government is not closed to the idea of wealth taxes.

As Second Minister for Finance Indranee Rajah said in Parliament (1 Nov 2021),

Income tax

What we have in Singapore today is one of the most progressive system of taxes and transfers in the world. It is a fair and sustainable system, and competitive as well.

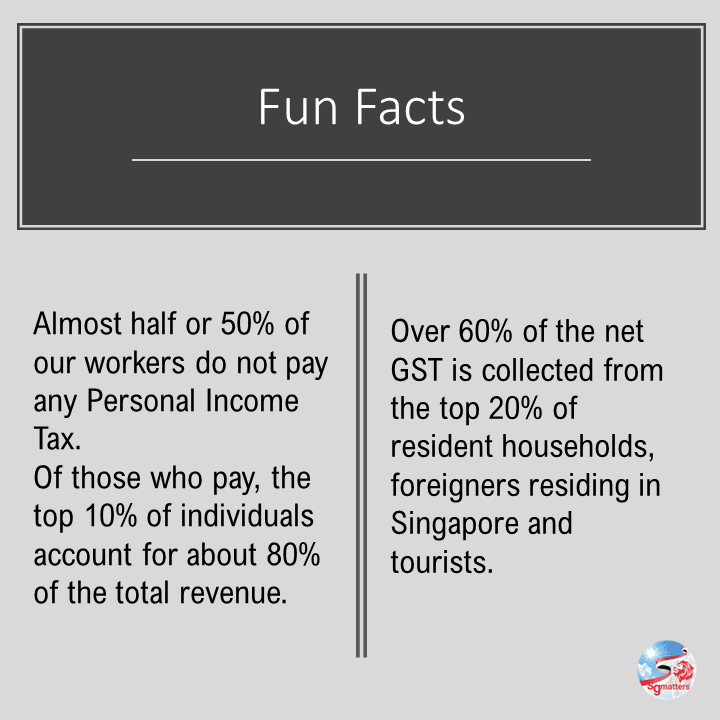

Almost half or 50% of our workers do not need to pay any Personal Income Tax. Of those who pay, the top 10% of individuals account for about 80% of the total revenue.

GST

Over 60% of the net GST from households and individuals is estimated to be collected from the top 20% of resident households, foreigners residing in Singapore and tourists.