Is there ever a good time to raise GST?

Truth is no one likes to pay taxes. This is why people will find every reason to justify why ‘now’ is not a good time to raise GST.

So there will never be a good or right time to raise GST.

The pandemic was though. Had it not been for strong Government support, many people would have lost their jobs when many economic activities came to a standstill.

Just when we thought the pandemic was going to blow over, the Russia-Ukraine war broke out, plunging the world into a food and fuel crisis, driving prices upwards.

What is certain in an uncertain world

Amidst rising geopolitical tensions, the world has become more uncertain, more volatile.

What is certain is that our needs will continue to grow and become more pressing.

Our population is ageing rapidly. 1 in 4 Singaporeans will be aged 65 and above by 2030. That’s just 8 years away. A growing proportion of elderly Singaporeans mean higher healthcare spending.

Besides an aged population, Singapore also has to address the problem of inequality in order to preserve social cohesion.

Ageing population means smaller income tax base

Even before the pandemic, it was pertinent for Singapore to increase its tax revenue to fund social spending.

Currently, approximately 30% of residents in Singapore pay the bulk of the personal income tax collected.

What this means is that the rest of the 70% pays none or very little personal income taxes.

As more seniors exit the workforce, the size of our local workforce will become smaller. This will put pressure on the personal income tax revenue collected.

Healthcare spending

In 2010, healthcare spending was $3.7 billion. This tripled in just 10 years to $11.3 billion in 2019. The total projected spending for 2022 is $19.3 billion.

By 2030, it is expected to be $27 billion.

If a long wait at the A&E will upset you, if you want good medical care and support for yourself or your family, if you think healthcare and social workers deserve better pay, then you will support the GST hike to make resources available.

You can’t argue for more support while also oppose the GST hike. You will put your money where your mouth is.

Social spending

Our social needs are getting more complex and the government is taking a family-centred approach to help people, hand-hold the individuals and families, and journey along with them like through ComLink and KidSTART.

This approach yields better outcomes but it is highly resource-intensive, and will invariably cost more.

If you believe that every child, regardless of background, deserves a good start in life, then you will support programmes like KidSTART and UPLIFT which target vulnerable children and children from disadvantaged background. You will support greater financial support for children from more needy families.

If you believe in building a kinder and more compassionate society, then you will support the whole range of programmes to help people – from supplementing their income through Workfare Income Supplement to giving financial support to those unable to work or those temporarily out of work, won’t you?

The GST hike will make more resources available to help people in need, especially at a time when they are feeling the impact of price increases.

If not now, then when? Helping people starts now when times are tough.

The only way be an inclusive people is by each and everyone of us playing a part. The bulk of the tax burden is already borne by half of working Singaporeans who pay income tax, with some paying much more than others. The other half of us pay no income tax. GST is the opportunity for everyone to play a part in building an inclusive and compassionate society.

Our GST rate is very much lower than the global average

At 7%, our GST rate is amongst the lowest in the world, and even in the Asian region.

The global average standard VAT/GST rate is 19% while the average in Asia is 11.6% in 2021.

Even after a hike of 2%, Singapore’s GST will still be much lower than the global average and still below the Asia average rate.

By itself, the GST may be regressive, but the Singapore Government has turned this regressive tax into a progressive on through the permanent GST Voucher Scheme.

Low and lower-middle income groups receive rebates in the form of cash and rebates for utilities and S&CC which help to offset the GST they pay.

For many years, the older generation like the pioneer and the Merdeka generation did not get to enjoy any contribution from the NIR (Net Investment Returns) Framework. They made a sacrifice. Today, we get to spend 50% from this framework which has helped to keep taxes low.

Let’s emulate the grit and resilience of the older generations and take the GST hike in our stride.

So come on, Singaporeans! Let’s do right by one another, support the GST hike for a reliable and sustainable source of revenue to fund social spending and healthcare.

Do you know?

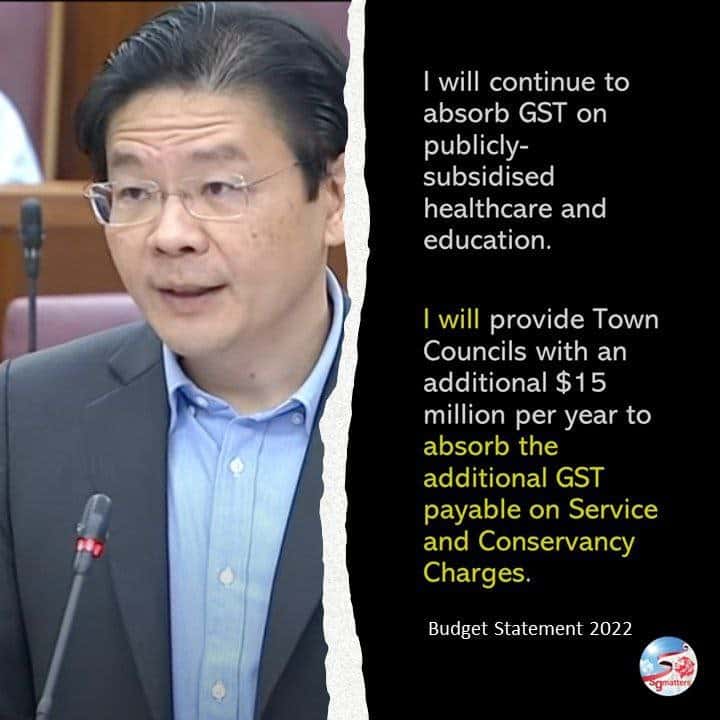

GST is absorbed by the Singapore Government for all publicly subsidised healthcare and education.