As a percentage of GDP, Singapore’s gross national debt-to-GDP ratio is 131.19%. It is the 6th highest in the world (as of 2020) (source: IMF).

However, no one is batting an eyelid or losing sleep over it. This is because Singapore actually owes nothing at all. The country does not borrow to spend. It borrows to invest.

The Singapore Government has a strong balance sheet, with assets well in excess of its liabilities. The country has a net debt-to-GDP ratio of 0%. (i.e. no net debt). Singapore is, in fact, a net creditor country.

How do we know Singapore's net debt is zero?

This can be seen from the net investment returns contribution (NIRC) that is made available for spending on the Government Budget.

Under the NIR framework, up to 50% of the long-term expected returns earned on the net assets (i.e. assets net of liabilities) are available for spending.

The NIRC of about S$19.6 billion taken into the Government’s budget for spending in Fiscal year 2021 means that even after deducting all the Government’s liabilities (including CPF monies), the remaining net assets are sizeable, and they are expected to generate significant investment returns.

If the Government’s assets had not been adequate to meet its liabilities, there would be no NIRC to fund the Government Budget.

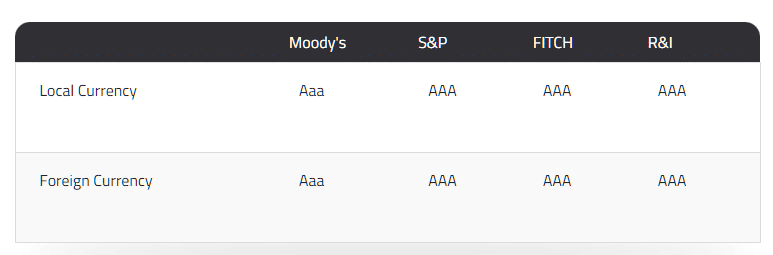

What is Singapore's credit rating?

Singapore has achieved top credit ratings of triple-A from all major credit-rating agencies.

In the October 2018 BlackRock Sovereign Risk Index update, Singapore ranked first in the BSRI in terms of credit worthiness. The BSRI tracks sovereign credit risk based on a range of factors which includes net debt-to-GDP, Government’s stability, and exposure to foreign currency debt.

Why does Singapore borrow?

Simply put, the country borrows to invest, not to spend.

The Singapore government does not borrow to fund running the country. Recurrent expenditure are funded by recurrent revenue collected through taxes. Singapore’s fiscal rule is based on the principle that a government must have a balanced budget over its term of office. That means any deficits in one year must be balanced by surpluses in other years during its term of office.

The government borrows to fund specific infrastructure projects. When these are completed, they result in assets that have value. Thus, the debts that the Singaporean government carries are matched by assets of equal or greater value.

Types of borrowing by the Singapore Government

The Singapore Government issues securities and saving bonds. Under the Government Securities Act, the borrowing proceeds from the issuance of these securities cannot be spent and are invested.

(1) Singapore Government Securities (SGS) are issued to develop the domestic debt market. They include Treasury Bills. They are marketable and are issued to foster the growth of an active secondary market. This enables Singapore to develop as an international finance hub and enhances our attraction to international banks.

(2) Special Singapore Government Securities are non-tradable bonds issued primarily to meet the investment needs of the Central Provident Fund (CPF).

Under the arrangements between the Singapore Government and the CPF Board, surplus CPF funds are invested in Special Singapore Government Securities. This relieves the CPF Board from taking on the investment risk of a fund manager to concentrate on its primary role as a national social security institution.

(3) Singapore Saving Bonds are introduced to provide individual investors with a long term saving option that offers safe returns.