One year ago during the budget debate in 2022, the WP suggested that corporate tax be raised in lieu of the GST hike.

In particular, WP MP Louis Chua suggested that raising the corporate tax rate to the proposed global minimum effective tax rate of 15 per cent, under Pillar Two of BEPS 2.0, could potentially generate $71.5 billion of revenue.

The purported sum that he threw out was not only seven times the corporate income tax paid by profitable non-SMEs (small and medium-sized enterprises), it is also the amount that the Government collects in total revenue from all taxes.

How on earth did he come up with such a huge sum?

Finance Minister Lawrence Wong said to him at that time: “Mr Chua should have paused at this huge number for a reality check. He says it is purely hypothetical. But he should have said it is wishful thinking.”

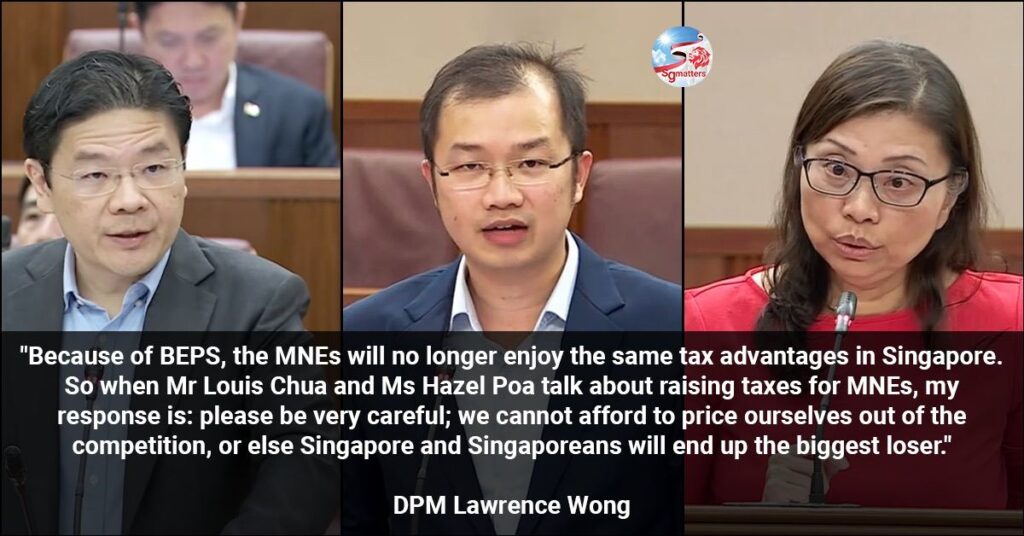

This year again (2023), the WP has suggested that corporate tax be raised as an alternative source of revenue. So did Hazel Poa of PSP.

A reality check is needed. The era of untrammelled globalisation that we enjoyed over the last 30 years is over.

The world has changed with heightened geopolitical tensions. Competition for global investments will get only tougher and more intense.

Countries are now rolling out vast subsidies to strengthen their competitive advantage over other countries. Businesses are re-organising themselves to account for once-unimaginable tail risks, including and especially, geopolitical risks. More and more multi-national companies are looking to re-shore, on-shore, or near-shore which means relocating production back to their home countries, to places nearby or close to large nodes of consumption, where they are also less likely to get caught up in geo-strategic crossfires.

DPM Wong said in Parliament that the US passed the CHIPS and Science Act and the Inflation Reduction Act last year. And the EU is responding with its own scheme – the Green Deal Industrial Plan.

Singapore may not be able to outbid the major powers in spending, he said. But we certainly cannot afford to stand still, he added.

"MNEs based here are not stuck with us permanently."

In his budget round-up speech, DPM Lawrence Wong said:

“Contrary to what Mr Louis Chua thinks, the MNEs based here are not stuck with us permanently. They are mobile and they have options. And they will certainly have more options when they decide on where to locate their next investment projects. Within the region, there are many other places where land and electricity are cheaper, and wages are lower.”

Don't price Singapore out of the competition!

“The MNEs are already making this clear to us in our consultation sessions with them. Because of BEPS, they will no longer enjoy the same tax advantages in Singapore. Meanwhile, other countries in the region are cheaper, while their home countries are offering very generous incentive packages. So they ask us: what else can Singapore offer to stay competitive?

A business sentiment survey conducted by the Singaporean-German Chamber of Industry and Commerce (SGC) in February this year found that 43 per cent of German firms polled would consider relocating certain business functions out of Singapore to other countries – namely Malaysia, Vietnam and Thailand – due to increasing costs and difficulty in recruiting talent.

“In fact, as we move to align ourselves with the BEPS rules, we will have to review and update our broader suite of economic development schemes to stay competitive,” he added.

Updating our broader suite of economic development schemes will require more funding resources, and that is why MOF’s assessment is that the net fiscal impact of BEPS to Singapore is unlikely to be favourable, Mr Wong said.