In Parliament (31 Oct), Dr Koh Poh Koon explained the adjustments to premiums to ensure that the MediShield Life Fund remains solvent, sustainable and able to meet its obligations to policyholders.

There are three factors that drives the proposed hike in MediShield Life premiums, Dr Koh said. The proposed hike in premiums will go to these three areas.

1. INCREASED CLAIMANTS AND PAYOUTS

The first is the increase in the number of claimants and payouts.

Over the last four years, there is a 30% increase in the number of claimants. At the same time, annual payouts have increased by about 40%.

Two-thirds of the premium increases will go to meet this growth in utilisation and payouts.

2. BETTER COVERAGE AND PROTECTION AGAINST LARGE HOSPITAL BILLS

One-quarter of the premium increases comes from refreshing the claim limits. This is to ensure that Singaporeans remain adequately covered for the majority of subsidised bills.

3. ENHANCEMENT TO MEDISHIELD LIFE

The remaining portion of the premium increases goes to support the benefits enhancement to the MediShield Life scheme. This includes the extension of coverage to inpatient hospices, serious pregnancy complications and treatments arising from attempted suicide, intentional self-injury, drug addiction and alcoholism etc.

BETWEEN 2016 AND 2019

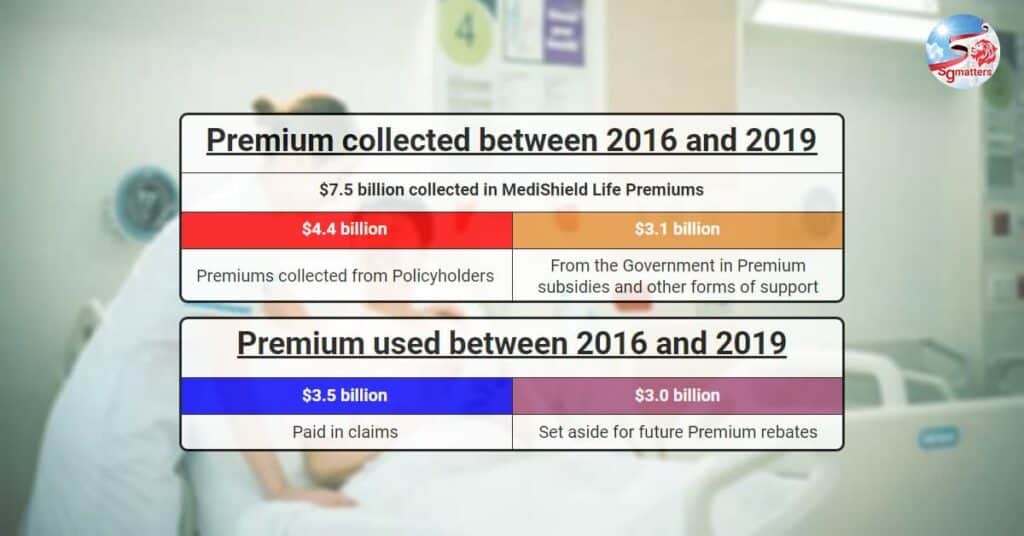

Premiums collected between 2016 and 2019 amounted to of $7.5 billion in total.

Of this, policy holders contributed $4.4 billion in premiums while $3.1 billion came from the Government in premium subsidies.

In the same period, payouts in claims made up a total of $3.5 billion while $3 billion was set aside for future premium rebates.

The Incurred Loss Ratio (ILR) of the Fund was an average of 104% over the period from 2016 to 2019 according to Dr Koh.

This means that the total premiums collected was slightly less than the total monies required to ensure that the Fund is able to meet current claims and future commitments.

MEDISHIELD LIFE FUND

For MediShield Life Fund to be able to meet its obligations to policyholders, it has to remain solvent and sustainable.

Premiums collected have to cover potential current and future payouts, including amounts set aside to support future commitments as well as provide a buffer against unforeseen contingencies such as unexpected spikes in hospitalizations due to disease outbreaks.

PREMIUMS SET ASIDE FOR FUTURE COMMITMENTS

As policy holders age, claims are likely to increase and so will premiums.

Part of the premiums paid by policyholders during their working ages are set aside to provide for future premium rebates. This constitutes the bulk of future commitments set aside in the reserves. It will help to moderate premium increases in their old ages. Other commitments include future payouts for diseases currently under treatment that will require multi-year care, such as renal failure and cancer.

KEEPING PREMIUMS AFFORDABLE

Several financial support schemes are available.

The Government provides subsidies of up to 50% for lower and middle-income households.

Merdeka Generation seniors receive additional subsidies of up to 10% on top of these premium subsidies while Pioneer Generation get special subsidies of up to 60%.

“Taken together, about 35% of total premiums were paid by the Government through various subsidies and support in 2019. For the elderly aged 65 and above, the contribution from the Government is higher, at about 50% of their premiums,” Dr Koh said.

[irp posts=”2247″ name=”MediShield Life premiums to go up with enhanced benefits and better coverage; $2.2 billion committed in premium subsidies”]

ADDITIONAL PREMIUM SUPPORT FOR MEDISHIELD LIFE

No Singaporean will lose their MediShield Life coverage, or be denied access to appropriate care, because of an inability to pay their premiums, Dr Koh said.

Singaporeans who continue to face difficulties even after subsidies can apply for Additional Premium Support. The Additional Premium Support will cover all outstanding premiums as well as future premiums, said Dr Koh.

COVID-19 SUBSIDY FOR ALL SINGAPOREANS FOR 2 YEARS

Dr Koh revealed that deferring the premium increase was something the Government had considered given the current difficult economic situation because of COVID-19.

“However, it was important that MediShield Life remains solvent and sustainable so that it can meet its obligations in time to come when policyholders make claims. Its coverage also has to be updated and enhanced to remain relevant to the healthcare needs of Singaporeans,” he said.

The Government therefore decided to provide a COVID-19 subsidy for all Singaporeans in the next two years in view of the current difficult situation.

In the first year, the Government will subsidise 70% of the net increase in premiums. This will be followed by 30% in the second year.

MEDISHIELD LIFE IS NOT-FOR-PROFIT SCHEME

Dr Koh pointed out that the MediShield Life is a not-for-profit scheme.

All premiums collected are placed in the MediShield Life Fund. They are used solely for the benefit of policyholders and in the administration of the scheme.

MOH publishes information about the Fund size, reserves and Incurred Loss Ratio on its website. An external auditor audits the financial accounts for the Fund and submits it to Parliament every year.

Slowing the rise in healthcare costs is key to maintaining the longer-term affordability and sustainability of MediShield Life premiums and the overall healthcare system. Everyone has to play a part.

Together, appropriate care can remain affordable for all Singaporeans.

[irp posts=”2038″ name=”Singapore leads the way in healthcare: Sean Masaki Flynn”]