This creates unnecessary anxiety for people who may not be aware that there are other choices available.

To put in perspective, flats that are sold for at least $1 million made up only 0.3 per cent of total resale transactions this year, National Development Minister Desmond Lee revealed in Parliament on Wednesday (Oct 14).

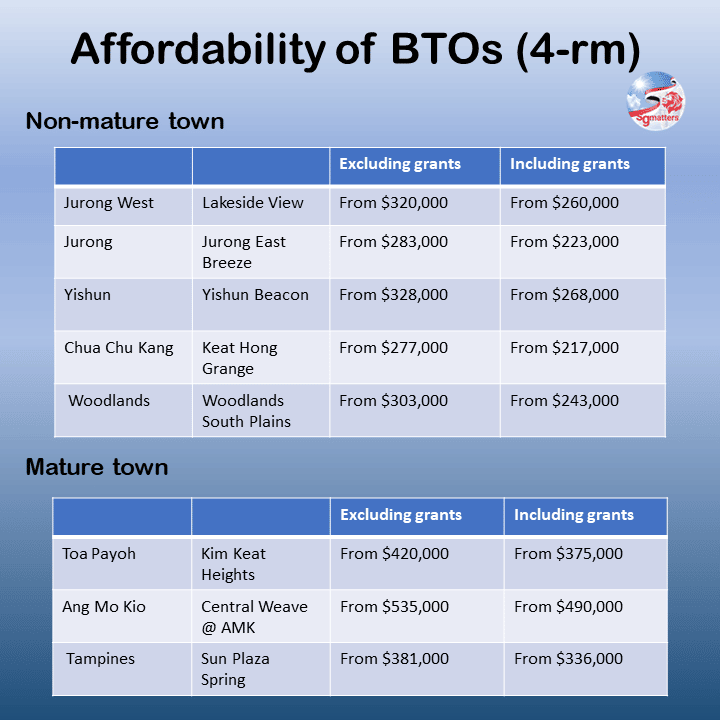

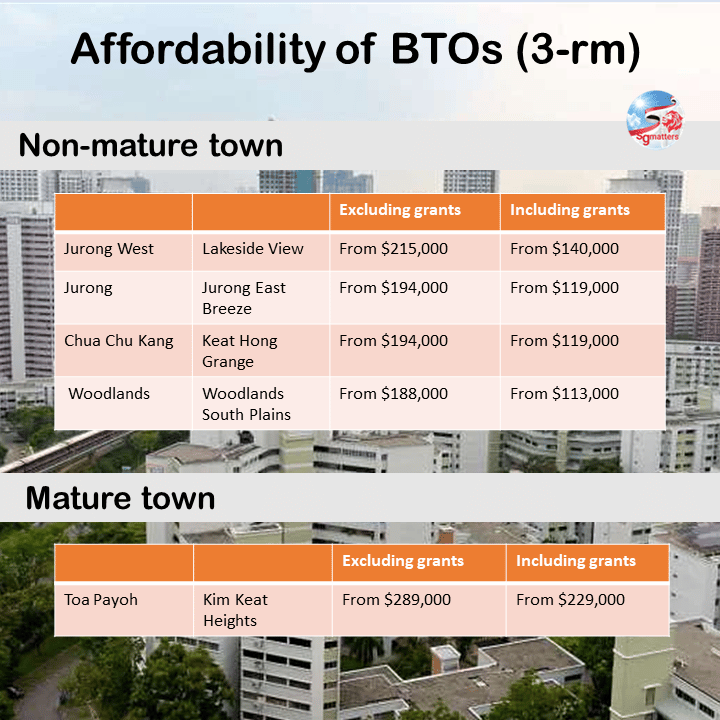

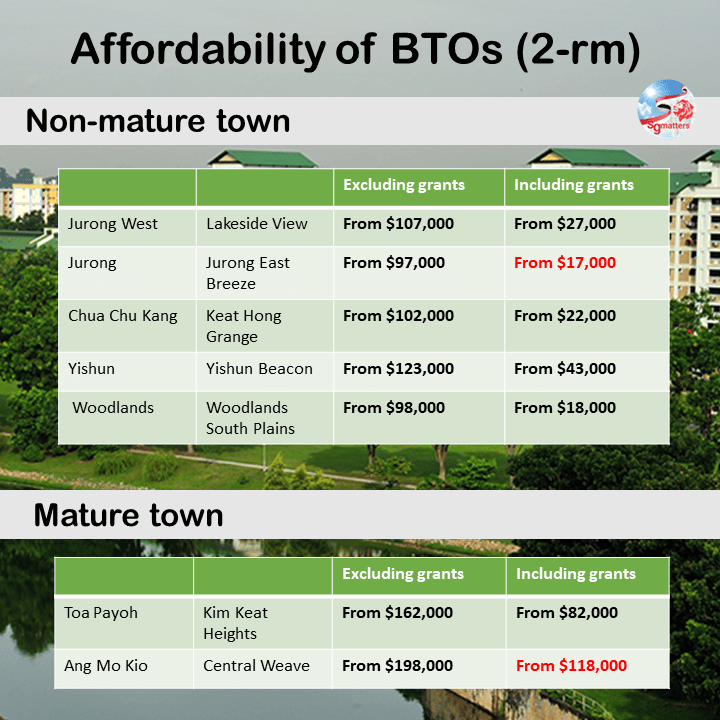

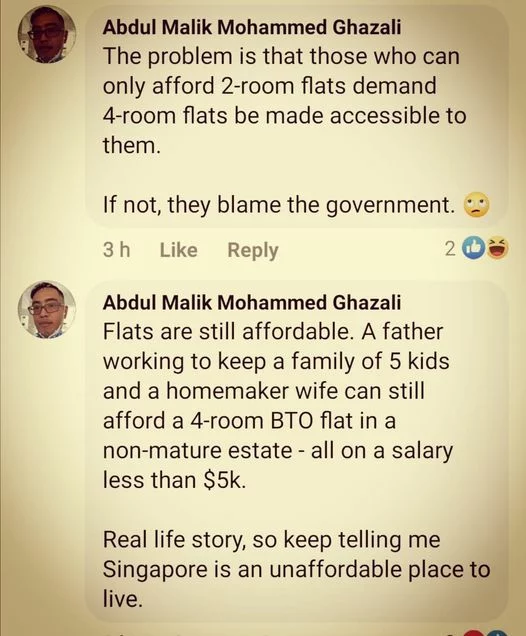

One must remember that affordability does not mean having all our expectations and desires met. It means adjusting our expectations to fit our financial ability.

Clearly, many are able to afford these flats even with HDB’s income ceiling eligibility criterion.

Even for the low income earner, a new BTO is still within reach, made possible by a maximum grant of $80,000. Take note that this grant stays with the home owner even when he sells his flat later on. It is money deposited into his CPF account and becomes part of his CPF savings. It is literally a gift from the government, a form of wealth transfer to help those with less.

A 2-room flat in a non-mature town costs as little as $17,000. It is definitely affordable.